Filter & Sort

A Stricter Test for College Programs

Critics argue that the earnings test, which is based on the average earnings of a high school graduate with no college, is unfair. But supporters say it provides key information.

Not Just a War on ‘Woke’

Attacks on public higher education in Florida are part of the radical right’s broader antidemocratic agenda, Timothy V. Kaufman-Osborn writes.

Default Likely to Negatively Impact Country’s Economy, Higher Ed

Experts and lobbyists warn that the economic consequences of a government default will make it more expensive for colleges to operate and harder for students to afford tuition and for researchers to work.

Ohio State Board Pushes Back on Anti-DEI Bill

Ohio State’s Board of Trustees blasted a State Senate bill one day before it passed. The rare move comes as culture war politics drive education reforms across the U.S.

New, Stronger Gainful Employment Regs Released

The rule adds more requirements for all postsecondary nondegree programs and all programs at for-profit institutions. Education Department officials hailed the regulations as the strongest ever gainful-employment rule.

University of Phoenix to Affiliate With University of Idaho

After deal with Arkansas system breaks down, a new entity created by Idaho is poised to buy and manage the for-profit giant as a nonprofit university.

Cardona Clashes With Republicans

Secretary Cardona fielded questions about the Education Department’s student loan policies and proposals for transgender student athletes during the nearly five-hour hearing, which became contentious at times.

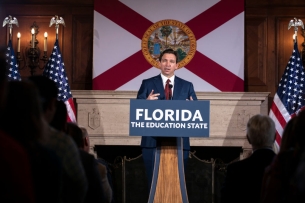

DeSantis Signs Bill to Defund DEI

Pagination

Pagination

- 158

- /

- 435