You have /5 articles left.

Sign up for a free account or log in.

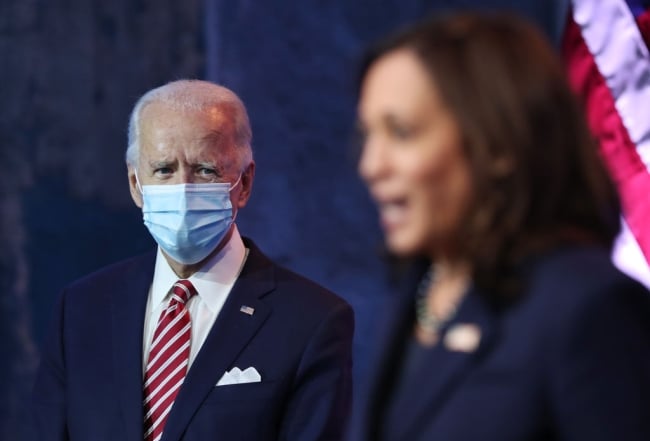

President-elect Joe Biden (L) looks on as Vice President-elect Kamala Harris delivers remarks about the U.S. economy during a press briefing at the Queen Theater on Nov. 16, 2020 in Wilmington, Del.

Joe Raedle

A coalition of 236 mostly progressive groups, including close allies like the American Federation of Teachers and the National Education Association, called on the president-elect on Wednesday to cancel student debt using his executive powers on the first day he takes office.

In a letter to Joe Biden and Vice President-elect Kamala Harris, the groups did not specify how much debt they’re asking to be canceled. But they noted that Biden pledged during the campaign to cancel $10,000 of each borrowers’ debt “immediately” as part of his response to the coronavirus epidemic.

“Before the COVID-19 public health crisis began, student debt was already a drag on the national economy, weighing heaviest on Black and Latinx communities, as well as women. That weight is likely to be exponentially magnified given the disproportionate toll that COVID-19 is taking on both the health and economic security of people of color and women,” the groups wrote, saying “bold action is needed.”

However, when asked about dealing with the issue through an executive order, Biden and his campaign’s national policy director have stopped short of vowing to act alone and instead mentioned the more tortuous path of going through Congress.

At a press conference Monday where he discussed the economic recovery plan he’s working on, Biden was asked if canceling some of the nation’s $1.5 trillion in student debt figured into his plan, and if he’d do it through executive order.

“It does figure in my plan,” he said without directly answering whether he would act through an executive order. He pointed instead to his support for the COVID-19 relief package pushed by House Democrats.

”I’ve laid it out in detail,” he said. “For example, the legislation passed by the Democratic House calls for immediate $10,000 forgiveness of student loans.”

Stef Feldman, the Biden campaign’s national policy director, also mentioned a legislative path when he was asked about an executive order during a call with members of the Education Writers Association.

“Vice President Biden has embraced the proposal, which I actually think was originally put forward by [Democratic] Senator [Elizabeth] Warren. In the midst of this crisis, she proposed legislation to ensure that we cancel $10,000 of debt for every student debt holder immediately, given the moment we are in. And that’s the proposal that Vice President Biden has embraced.”

Alexis Goldstein, senior policy analyst for Americans for Financial Reform, a progressive advocacy group calling for widespread student debt cancellation and one of the signers of the letter, said she didn’t read much into those comments.

The groups, which also include the NAACP, and advocacy groups for borrowers such as Student Debt Crisis, urged action as soon as Biden takes his oath of office.

“There is growing energy and strong bipartisan public support for immediate broad-based debt cancellation,” the groups wrote. “Such executive action is one of the few available tools that could immediately provide a boost to upwards of 44 million borrowers and the economy.”

Congressional Republicans have opposed student debt cancellation this year during negotiations of coronavirus relief packages, believing it is unfair to people who didn't go to college. The letter also noted that Warren and Senate Minority Leader Chuck Schumer in September called on the next president to cancel $50,000 in federal student debt from all borrowers through an executive order, a move that would completely eliminate the balances of 75 percent of all borrowers.

During the campaign, Daniel Zibel, the Education Department’s deputy assistant general counsel for postsecondary education in the Obama administration, also called on the next administration to push the bounds further than the department has gone before on what they believe the nation’s higher education law allows it to do.

In a series of policy papers, Zibel and Aaron Ament, chief of staff of the Education Department’s general counsel’s office under the Obama administration, have urged a Biden administration, without going to Congress, to unilaterally cancel the student debt of those whose colleges have closed and of all those who have been defrauded by their institutions. The National Student Legal Defense Network, founded by Zibel and Ament, also argued Biden has the power under the Higher Education Act to cancel the debt of borrowers with disabilities and to make the owners of for-profits that defrauded students financially liable for all forgiven debts and other costs to the federal government.

“While enacting debt cancellation through legislation would be welcome, legal analysis has shown HEA includes the authority the incoming administration needs to broadly relieve borrowers of student loan debt,” said Kyle Southern, higher education policy and advocacy director for the Young Invincibles, a millennial advocacy group that also signed the letter to Biden and Harris.

On the other hand, Biden could alienate congressional Republicans if he were to sidestep them through an executive order, said Frederick Hess, director of education policy at the conservative American Enterprise Institute. And he will need their support to pass other elements of his agenda, he said.

Some voices in his administration could also question the wisdom of canceling debt. On Sunday night Jason Furman, who served as President Obama’s chief economist and is being mentioned for a similar role in the Biden administration, cast doubt on the wisdom of widespread debt relief on Twitter.

Furman, who has been mentioned in press reports as a potential chairman of Biden’s Council of Economic Advisors or chairman of the Federal Reserve, essentially argued that any debt cancellation would be taxable.

So any relief that borrowers would get would be offset at least in part by their having to pay higher taxes. As a result, the amount of money borrowers would have left to spend and pump back into the economy wouldn’t justify the potential $1 trillion cost of forgiving debt.

“Student loan debt forgiveness likely has a multiplier close to zero,” tweeted Furman, now a Harvard University economic policy professor. “Forgiveness is taxable. If this negative cash flow effect outweighs interest savings would even be net negative. And wealth effect small in short run.

“Arbitrary/regressive $1T for ~$0 GDP, not a great idea,” he wrote.