You have /5 articles left.

Sign up for a free account or log in.

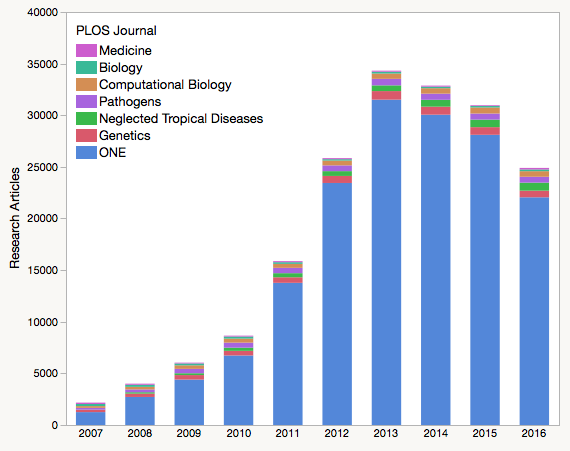

PLOS ONE, the largest scholarly journal in the world, continues to shrink.

The open-access mega-journal’s output, measured by how many articles it publishes a year, last year fell to 22,054 -- its lowest since 2012 and down about 30 percent since its peak in 2013. Last year brought the most precipitous drop yet. PLOS ONE published 6,052 fewer articles in 2016 than it did the year before -- a drop of about 22 percent.

The decline was first reported by Phil Davis, a consultant who specializes in scholarly publishing, in a blog post this morning.

Joerg Heber, who became PLOS ONE’s new editor in chief in September, addressed the decline in a blog post last month. Reflecting on the journal’s first 10 years, he noted that many other publishers are now using similar models for their own publications.

As a result, “the submissions to PLOS ONE have decreased, posing the question of our continuing unique value in this market,” Heber, former executive editor of the open-access journal Nature Communications, wrote. “There will be challenges, but irrespective of our size, PLOS ONE will always play an important role towards PLOS’s broader goal as a nonprofit organization to support and advocate open science.”

Compared to most journals, PLOS ONE is still massive. As recently as 2010, the journal published fewer than 10,000 articles. But because of the journal’s outsize impact on the financial health of its nonprofit publisher, PLOS (short for Public Library of Science), a continued drop could one day become a problem.

Source: The Scholarly Kitchen

PLOS also publishes six other peer-reviewed, open-access medicine and science journals, but only about 11 percent of the total scholarly articles it publishes appeared in those journals -- up from about 8 percent in 2013.

Since PLOS funds itself mainly by charging authors a publication fee ($1,495 for PLOS ONE, $2,250 or $2,900 for the other six journals) rather than charging readers a subscription fee, its revenue is directly tied to how many articles it publishes.

PLOS’s net revenue has fallen as its output has declined and its expenses increased. According to tax documents, the publisher last year reported net revenue of $566,229, down from $10 million two years before.

"Should PLOS ONE cease to serve s the cash cow for the organization, [PLOS] will need to adopt a new business strategy," Davis wrote.

Davis, a former science librarian, has for years followed PLOS ONE’s growth and how PLOS has managed it. In the post, published by the blog The Scholarly Kitchen, he pointed to a number of possible reasons why the journal is receiving fewer submissions and publishing fewer articles.

Competition is one of them. The open-access publishing market has grown dramatically since PLOS ONE began publishing in 2006, as Heber noted. Scientific Reports, an open-access mega-journal launched by Springer Nature not even six years ago, last year published 20,541 scholarly articles -- nearly twice as many as the 10,720 it published in 2015. And while Scientific Reports' Journal Impact Factor -- a metric commonly used to gauge the quality of a journal -- has risen, PLOS ONE's has declined.

Scientific Reports looks poised to displace PLOS ONE as the world’s largest journal this year if the trends continue (though the journal did raise its publication fee this week, making it $200 more expensive than PLOS ONE).

PLOS’s own policies could also be driving researchers to publish their work elsewhere. Its decision to raise the PLOS ONE article processing charge from $1,350 to $1,495 last year caused a stir among some academics, as did a 2013 policy that required authors to point readers to where the data behind their findings could be found.

PLOS appears to have prepared for leaner times, however, as it has amassed more than $30 million in assets. Michael B. Eisen, a professor of biology at the University of California, Berkeley, who co-founded PLOS, last year wrote a blog post in which he defended the publisher’s article processing charge rates and double-digit margins. Those, as well as PLOS’s savings, he wrote, are required for the publisher to maintain its financial stability.

“This is particularly the case with open-access publishers, since we have no guaranteed revenue stream -- in contrast to subscription publishers who make long-term subscription deals,” Eisen wrote. “What’s more, this industry is changing rapidly, with the number of papers going to open-access journals growing, but many new open-access publishers entering the market. … The only way to survive in this market is to have a decent amount of money in the bank to buffer against the unpredictable.”

Neither Eisen nor PLOS responded to questions sent to them by email.