You have /5 articles left.

Sign up for a free account or log in.

Between 2008 and 2019, the annual number of births in the United States fell by more than half a million, and my previous analyses, co-authored with Melissa Kearney, forecast that COVID-19 will pile on to that decline. As those smaller cohorts hit college age by 2026, enrollments will begin to fall.

In a new book, The Agile College, Nathan D. Grawe updates his original forecasts, predicting that 9 percent fewer students will enroll in college by 2034 compared to 2025. Although those estimates foreshadow difficult times ahead for America’s colleges and universities, the financial burden these institutions face is about revenue, not enrollment. I estimate that even though fewer children will be born in the coming years, a greater number of them will be able to pay more to attend college, tempering the impact of the baby bust on college revenue.

The contribution of Grawe’s work is to recognize that the decline in births does not translate directly into a decline in enrollments for a variety of reasons, including the changing composition of those births. The purpose of his analysis is to incorporate those changes into a forecast of future enrollments. I’ve adopted a similar, albeit less comprehensive, approach to forecast the future ability to pay for college among those children born.

I began by using detailed Vital Statistics data, available from the National Center for Health Statistics, on births that occurred in 2002, 2007, 2013 and 2018. These births represent potential college-entry cohorts in 2020, 2025, 2031 and 2036. The data include information on the mother’s level of education and her age when she gave birth, factors that correlate highly with her socioeconomic status, or SES. Children born to highly educated mothers who are older when giving birth are more likely to have greater economic resources at that time and when the child approaches college age.

The data indicate that births to higher-SES women have been rising; the decline in births is observed entirely among lower-SES women. Between 2002 and 2018 (college-entry cohorts of 2020 and 2036), the number of births to mothers with college degrees increased by 200,000. The number of women giving birth who have dropped out of high school, in contrast, has fallen by 400,000. A similar pattern emerges when it comes to the mother’s age at birth; births among women under age 25 fell by a larger amount than births to women age 30 and over rose.

All that said, however, the amount that a student is expected to pay for college is largely a function of a family’s financial characteristics at college entry, not simply a mother’s education or age at birth. To address that issue, I used data from the 2016 Survey of Consumer Finances, which contains detailed information on family finances, focusing on those families with children approaching college age (between ages 13 and 17). I applied an algorithm to those data designed to approximate the way institutions use family finances to estimate expected family contributions, or how much each student can afford to pay for college, for those students.

The survey data also contain information on the mother’s age at the birth of her child and her level of education. That enabled me to estimate the relationship between those characteristics and the expected family contributions. I forecasted those contributions for future college-age cohorts by applying the maternal characteristics of children born between 2002 and 2018 to those estimates.

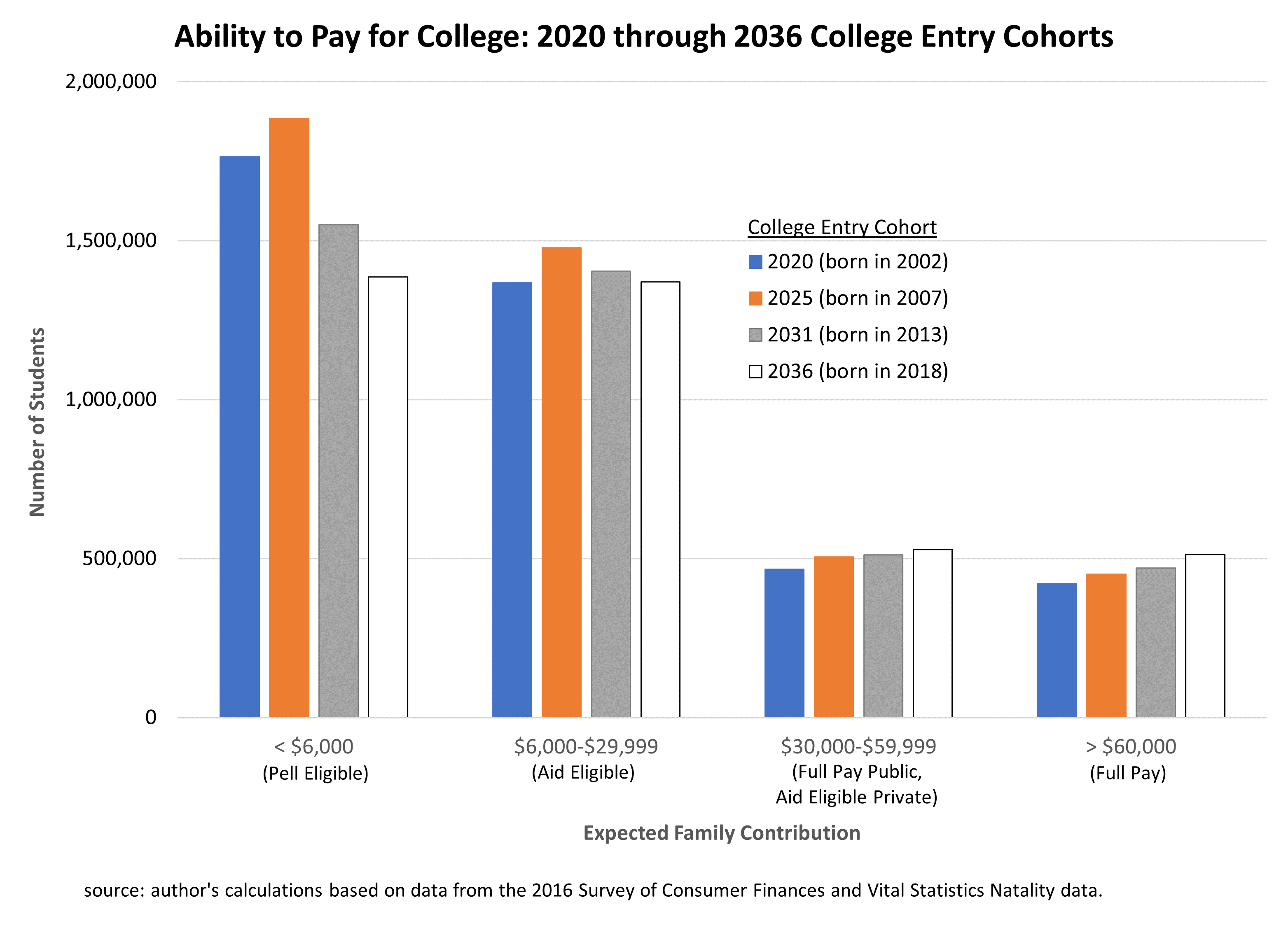

I coarsely divided the students into four categories based on expected family contributions. I defined students eligible for Pell Grants as those with an EFC below $6,000 (technically, it would be $6,345 in 2020-21). Then I assumed an approximate total cost of attendance of $30,000 and $60,000 at public and private institutions, respectively, based on data for four-year institutions for students living on campus. I also defined eligibility for financial aid beyond Pell as an expected family contribution below that sticker price.

I found that the number of students who will require financial aid at public institutions in the coming years will still be larger than the number who can pay full price. But the greatest decline in the college-entry cohort sizes will most likely occur among those who can afford to pay less for college, rather than those who can afford to pay more. The number of students who would be Pell-eligible, with an expected family contribution below $6,000, will shrink by 26 percent between 2025 and 2036, while the number who can afford to pay more -- measured as full pay at either public or private institutions -- will in fact rise 9 percent.

I should note that these forecasts assume that the translation from mother’s socioeconomic status to the child’s ability to pay at the time of college entry remains stable over the next 15 years. An analogous caveat is appropriate regarding the enrollment forecasts in Nathan Grawe’s work, which he acknowledges. Geographic variation, which Grawe emphasized in his forecasts, is also possible here, although I did not conduct analyses separately by region.

Nonetheless, these results have important implications for the impact of declining college enrollments. First, the financial impact on colleges will be less severe than some people may have expected just based on the forecasted enrollment numbers. Second, institutions that are seeking to diversify their student bodies by socioeconomic status will need to work harder to attract a smaller number of less affluent students. Third, those institutions that enroll a disproportionate share of high-financial-need students will face an even greater uphill struggle to manage enrollments.

All of these conclusions support the continuing need to maintain and strengthen the financial aid system despite the anticipated decline in enrollments. Both the federal government and institutions themselves will need to dedicate greater funding for financial aid to enroll a higher percentage of the fewer lower-income students available.