Free Download

Private four-year colleges may be getting real about their institutions’ financial future, to judge by the views of the men and women closest to their balance sheets.

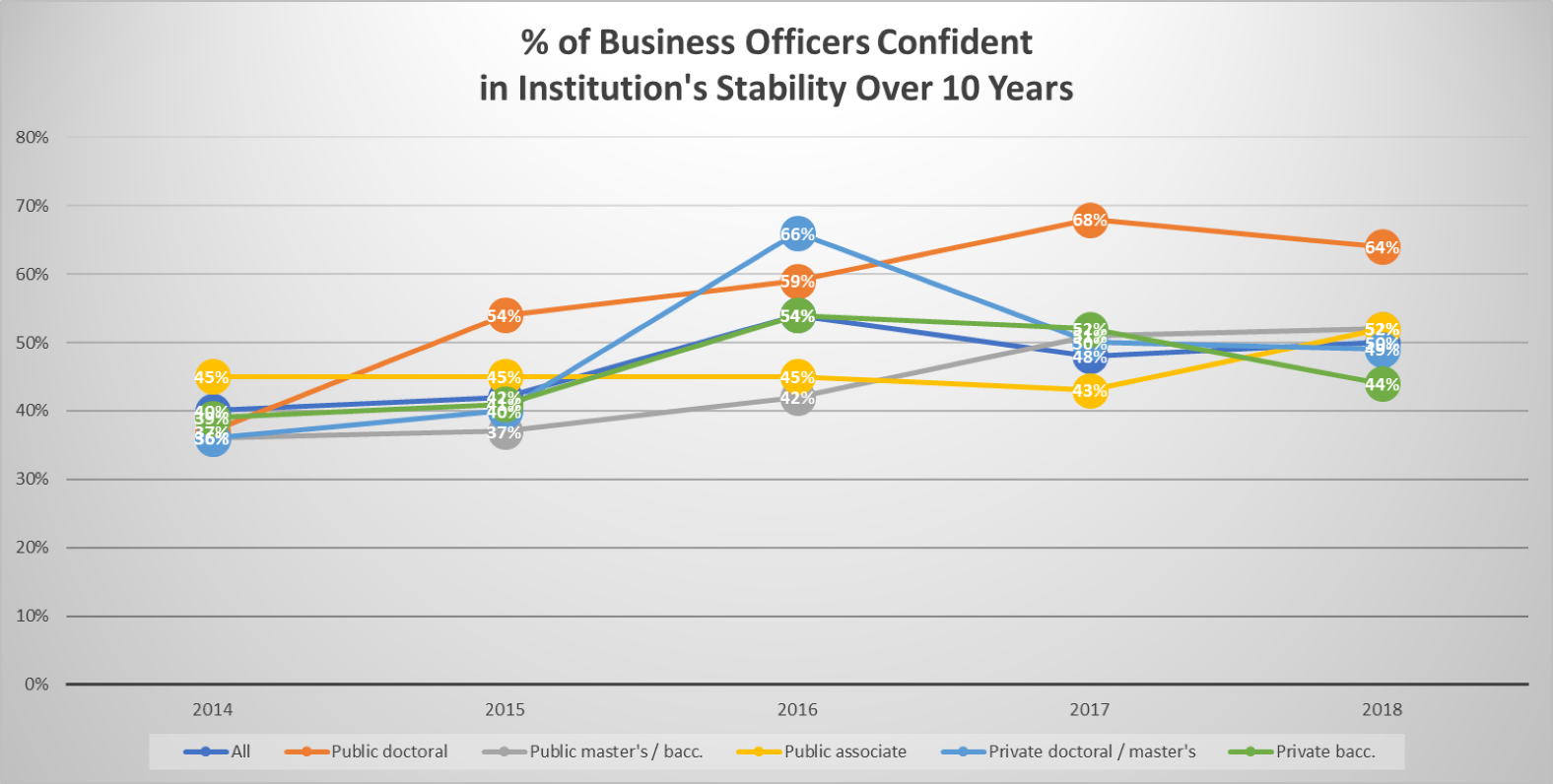

Inside Higher Ed’s 2018 Survey of College and University Business Officers finds that just 44 percent of chief financial officers at four-year baccalaureate colleges say they are confident their college will be financially stable over the next 10 years, down from 52 percent a year ago and 54 percent in 2016.

That has the chief business officers of those institutions thinking much more seriously than they have in the past about taking drastic measures. Twenty-four percent of private baccalaureate college financial officers say leaders at their college have had “serious” discussions about a merger, more than any other sector and almost five times more than answered that way a year ago (5 percent). A similar proportion (26 percent) say their college should merge with another.

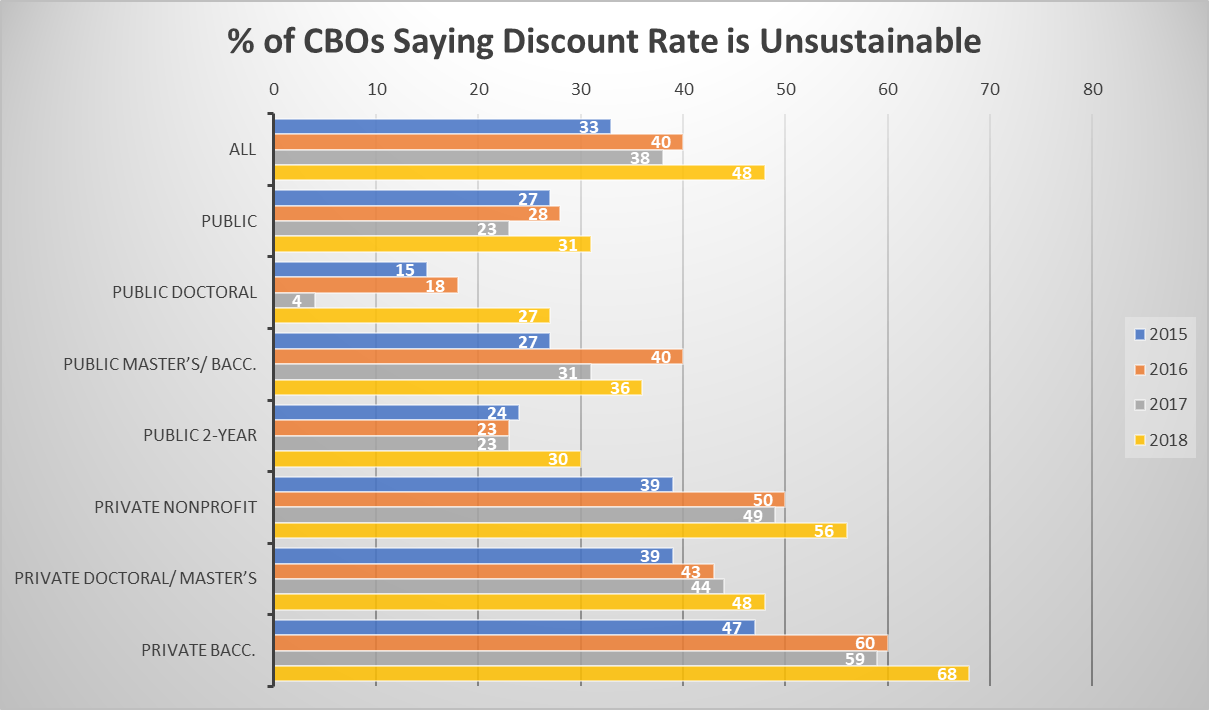

And more than two-thirds (68 percent) of financial officers at four-year private colleges now acknowledge that their tuition discount rate is unsustainable, markedly higher than last year's 59 percent and 47 percent in 2015. (It was at 60 percent in 2016.)

About the Survey

Inside Higher Ed’s 2018 Survey of College and University Business Officers was conducted in conjunction with researchers from Gallup. Inside Higher Ed regularly surveys key higher ed professionals on a range of topics.

On Monday, Inside Higher Ed’s Doug Lederman and business officers from Marymount California University, Stockton University and the University of Wisconsin Colleges will discuss the survey at the annual meeting of the National Association of College and University Business Officers. More information on that session can be found here.

On Thursday, Aug. 9, at 2 p.m. Eastern, Inside Higher Ed editors will analyze the survey’s findings and answer readers’ questions in a free webcast. To register, please click here.

The Inside Higher Ed survey of business officers was made possible in part by support from Laserfiche, Oracle, Student Services by Blackboard, Unit4 and Workday.

The travails of private four-year colleges stand out in this year's survey of business officers, conducted in conjunction with researchers at Gallup. But other highlights of this year's study include the following:

- Business officers over all are modestly more confident about their institutions' financial sustainability over a decade than they were last year. Public college CBOs are more upbeat than their private college peers, with community college officials showing a marked jump (to 52 percent from 43 percent last year).

- About one in six CBOs say campus administrators have seriously discussed a merger, and a quarter say senior officials have discussed consolidating programs or operations with another college in the last year. Most business officers say their institution is unlikely to merge with another, but almost one in five says their college should merge.

- Roughly four in five chief business officers say trustees and senior administrators at their campuses are realistic about the financial challenges confronting their institutions. But the proportion of CBOs holding that view has been dropping, to 80 percent this year from 86 percent two years ago. And chief business officers who express a lack of confidence in their institution's financial future are far less likely than their peers (74 percent vs. 87 percent) to praise their bosses' business savvy.

- About two-thirds of business officers say their financial reports are based on accrual rather than cash accounting -- an approach that higher ed finance experts say may mask underlying financial weakness for struggling colleges.

The Fate of the Four-Year Privates

With all the news circulating about the struggles of four-year private colleges, from closures to mergers to faculty layoffs, it would be surprising if their financial officers were not concerned. Yet the same thing could have been said in most recent years, and their leaders have remained relatively upbeat about their institutions' futures.

This year's Inside Higher Ed survey can be read as indicating a shift, but it should not be overstated. For every answer that suggests that chief business officers recognize major problems, you can find another that shouts, "No worries, we're good." Contradictions abound. (It is also possible that differences in who responded to the survey could result in some overstatement of the differences.)

Let's start with the closest thing we have to a consumer confidence index on higher ed finance, our survey question on how confident business officers are that "my institution will be financially stable" over five and 10 years.

As seen in the chart below, the CBOs of private four-year colleges (the line in green) are the least confident, with officials at public doctoral universities the most by far. Public college business officers are generally more upbeat than their private college peers, though most sectors' confidence levels fell rather than rose in the last year. The major exception was among community colleges, even though the institutions continue to lose enrollments.

The CBOs’ view is also quite a bit more pessimistic than the assessment made by presidents of those institutions in Inside Higher Ed's annual survey of chief executive officers in March, when 54 percent of four-year private college presidents expressed confidence in their institutions' stability over a decade.

Larry Ladd, director of the higher education practice at Grant Thornton, said he was not surprised that the business officers are more pessimistic than their presidents, since you "hire the business officer to be skeptical."

He said the data suggest that the leaders of small private colleges are moving beyond what he called "denial" about their financial situations and are increasingly "understanding their financial circumstances to be enduring" rather than temporary. That appears to have them "looking at changes they should make to adapt to a different level of revenue, and to change their cost structures to a different level of revenue."

The Growing Role of

Mergers in Higher Ed

Inside Higher Ed's new special

report on mergers and consolidations

is must reading for campus leaders.

The study contains journalistic

analysis, data and practical

guidance for college leaders, and

is available for purchase here.

The survey does provide some evidence that chief business officers at private baccalaureate-level colleges are increasingly willing to consider dramatic changes.

Last year just 5 percent of them said senior leaders at their colleges had discussed merging with another college, a lower proportion than any other sector (the overall average was 12 percent). In this year's survey, that proportion shot up to 24 percent, well over the 17 percent average for all respondents. (Nine percent of public college CBOs said they'd had such discussions.) A third or more say that senior officials have had serious discussions about consolidating some administrative operations or academic programs with another college.

A quarter (26 percent) said their institution should merge with another, and more than half said their institution should share administrative functions or combine academic programs with another college in the next three years, although far fewer said those things were likely to happen.

In addition, as seen in the chart below, CBOs at private baccalaureate colleges were far likelier this year (68 percent) than in the past to acknowledge that their tuition discount rate is unsustainable.

Concern about tuition discount rates rose across all sectors (with an especially notable gain among business officers at public doctoral universities), but the fact that more than two-thirds of business leaders at private four-year colleges now believe their discount rates are unsustainable is noteworthy.

The business officers' increasing concern about discount rates as an indicator of financial unsustainability surfaces elsewhere in the survey, too. In response to a question about strategies that CBOs say their institutions will use in the 2018-19 academic year to "compensate for insufficient revenue" (more on that question later), 42 percent of private college business officers strongly agreed (32 percent) or agreed (10 percent) that they will lower their discount rate, up from a combined 29 percent the year before.

But they (and, to be fair, their peers in other sectors) were far likelier to say that they would focus in the coming year on increasing overall enrollment (82 percent), "launching new revenue-generating academic programs" (65 percent) and master's degrees (52 percent). They seem comparatively disinclined to pursue strategies that might cause more pain (or be more controversial) on campus, such as eliminating underperforming academic programs (33 percent), increasing teaching loads for full-time professors (31 percent) or promoting early retirement for administrators and staff members (25 percent).

The emphasis on enrollment growth over cost-cutting, and the fact that 43 percent said they would enroll more full-pay students, suggest a disconnect in the degree to which the business officers really believe themselves to be under financial strain, said Kasia Lundy, a leader of the education group at EY-Parthenon.

"You have the high percentage that feel the current discount rates are unsustainable, but when you ask them what their strategy is, they say to get more students," she said. "But the only way to get that may be to maintain or increase your discount rate, so those answers don't really make sense side by side."

Lundy said the survey's results, taken together, left her feeling that many CBOs at private colleges may remain "too optimistic for the state of the market."

Feeling the Pressure

Another cut of the data suggests that financial pressures are affecting how college leaders view their situations.

Gallup provided data that compared respondents' answers based on whether they were confident in their own college or university's financial stability over 10 years. On most counts -- but not all -- those who were more pessimistic seemed more willing to make significant changes.

For instance, while 17 percent of all chief business officers said their senior leaders had seriously discussed a merger in the last year, CBOs who lacked confidence in their institution's financial future over a decade were likelier than their peers (23 percent to 11 percent) to say such discussions had occurred. They were also likelier to believe their institution would merge (13 percent to 8 percent), to say their institution should merge (26 percent to 10 percent), and to say that it should share administrative functions with another college within three years (58 percent to 43 percent).

They were also twice as likely (32 percent to 17 percent) to strongly agree that their tuition discount rate is unsustainable, but only modestly more likely to say they would cut their discount rate in. the coming academic year (29 to 26 percent).

Perhaps the most salient difference that emerged from the comparison between the confident and less confident business officers has to do with their views of their presidents and trustees. The survey asked CBOs how realistic other campus constituents were about their financial situations; over all, board members and presidents both earn plaudits from roughly eight in 10 finance officers.

But CBOs who question their institution's financial stability over a decade are 13 percentage points less likely than their peers to agree that trustees "are aware of and understand" the financial challenges facing the institution (72 vs. 85 percent), and 15 percentage points less likely to say the same about senior administrators (72 vs. 87 percent). That suggests that the top decision makers at financially vulnerable colleges (as judged by their internal financial experts) may not rush to accept their CBOs' analysis.

Transparency and Cash on Hand

Some colleges' financial struggles have appeared to catch many of their faculty and staff members by surprise, raising questions about whether campus leaders are being sufficiently honest and transparent about their fiscal situations. In response, this year's survey contained an expanded set of questions about chief business officers' views on how to gauge colleges' financial condition and how widely information about that condition is shared with others on the campus.

Almost one in 10 chief business officers said they did not run periodic financial reports that project their colleges' budgets to the end of the fiscal year, prompting one analyst who reviewed the survey to mutter, "Oh my god!" during a telephone interview.

A majority of CBOs (64 percent) said they ran such reports monthly, and another 27 percent said they did so quarterly. About three-quarters of all CBOs said those reports were distributed to the president's cabinet, 69 percent to the governing board or its finance committee, and far fewer to a faculty governing body (12 percent) or a student governing body (3 percent). Nine percent said the reports were not distributed to any of those groups.

The survey asked business officers how aware key campus constituents were about the financial health of their institutions and whether campus leaders were giving those groups "accurate and sufficient information" about finances.

About three-quarters of all CBOs said students, faculty and staff members, and alumni were either "very" (15 percent) or "somewhat" (61 percent) aware, with the lowest numbers at public doctoral universities (68 percent) and the highest at private baccalaureate colleges (84 percent). And 86 percent of CBOs said campus leaders were providing good information to other constituents.

One disconcerting note: business officers who expressed less confidence in their institutions' financial stability were significantly less likely to say that campus constituents were well informed about the fiscal picture, as seen in the table below.

| Confident in Institutional Stability Over 10 Years | Not Confident in Institutional Stability Over 10 Years | |

| Campus constituents are very aware of financial health | 18% | 12% |

| Campus constituents are somewhat aware of financial health | 63% | 58% |

| Campus constituents are given "accurate and sufficient" information | 94% | 77% |

Asked to rate the importance of various financial measures in assessing their institution's financial condition, business officers most commonly rated as "very important" the net operating revenues ratio, or operating surplus (55 percent), the increase or decrease in unrestricted net assets (53 percent), and the rate of growth of net tuition per student (52 percent). Down the list a bit was the monthly or annual days of cash on hand.

That last result troubled some finance experts, especially in combination with the finding that 66 percent of business officers said their periodic financial reports were based on accrual accounting and 34 percent said they used cash accounting. Accrual accounting recognizes revenue and expenditures when they are earned and billed, respectively, rather than when money actually changes hands.

Stefano Falconi, a managing director at Berkeley Research Group and previously a senior business officer at Simmons College, Stevens Institute of Technology and Carnegie Mellon University, among others, said it concerned him that chief financial officers weren't watching their cash more closely, especially those at institutions that are under financial strain.

"As revenue gets tighter, cash becomes increasingly important," Falconi said. "In that small slice of our practice that deals with distressed colleges, we're often called in when they run out of money."

Colleges' tendency to use accrual accounting may contribute to lack of awareness of their true financial situations, he said.

This may be particularly true because accrual accounting often does not anticipate how major upcoming expenses (such as capital expenditures and debt service) can draw cash down to (or below) dangerous levels, Falconi said. So an institution may be due to start paying a massive balloon payment on a 30-year bond that could significantly drive up its actual spending, and its financial reporting may not reflect that.

For many colleges, Falconi said, especially those in any way at financial risk, "reporting on an accrual basis … really is not a good idea."

The Picture for the Publics

Over all, public college chief business officers had a more positive assessment than did their private college counterparts. They are on average markedly more confident in their institutions' financial stability, less likely to believe their institutions need to consider drastic measures such as mergers or consolidations, and more comfortable with their debt levels.

The 2018 iteration of Inside Higher Ed's business officers' survey for the first time included a set of questions aimed specifically at public college CBOs.

Nearly a quarter of them (24 percent) said that their institution had frozen its tuition in the 2017-18 academic year, and 23 percent said the institution had a freeze planned for the upcoming academic year. Those at doctoral universities said so at nominally higher rates than did CBOs at master's/baccalaureate institutions and community colleges.

Doctoral university business officers also reported that smaller (and declining) proportions of their operating budgets are supported by state appropriations. The average CBO at a doctoral institution pegged that percentage at under a quarter and dropping to about a fifth in 2019, while those at other four-year publics and at community colleges reported that their proportions were holding steady in the 34-37 percent range.

The survey also sought to assess how business officers viewed their relationships with university systems (if they belong to one, which 58 percent said they do). CBOs were asked whether their multicampus system provides a set of shared services and, if not, whether it should.

The systems were most likely to provide legal services (80 percent), enterprise computing systems (76 percent) and an internal audit function (72 percent). After that there was a big drop-off to human resources (52 percent), shared academic program offerings (45 percent) and compliance (44 percent). Of those, CBOs expressed most interest in having their system provide compliance help, and least interest in shared academic programs.

Debt, Endowment Income and Other Topics

Here are some of the other highlights of the 2018 survey.

Debt and debt service. We asked an expanded set of questions related to institutional debt this year. On one question repeated from last year, slightly more business officers this year than last year said their institution had the appropriate amount of debt (77 percent vs. 73 percent in 2017), but more also said they had too much debt (14 percent vs. 12 percent). Far fewer (8 percent vs. 15 percent) said they should take on more debt. Differences by sector were large, though: last year just 4 percent of CBOs at public doctoral universities said they had too much debt, and this year 18 percent did. Last year just 9 percent of private baccalaureate business officers said they had too much debt; this year 22 percent did. (Note: These data may suggest some differences in who responded to the two years' surveys.)

A question this year asking CBOs how much of their institution's 2017-18 operating budget was dedicated to debt service showed a sizable gap between private and public colleges, influenced significantly by the lower debt of community colleges. Private nonprofit colleges had a mean debt service percentage of 6 percent, compared to 3.1 percent for publics. But the mean for public doctoral universities was much closer to the private level, at 4.9 percent.

About a third of CBOs (32 percent) reported their current viability ratio (expendable net assets divided by long-term debt) as being above 2.0, and roughly a similar proportion (34 percent) said it was at or below 1.0. The higher the viability ratio, the stronger an institution is considered to be, financially. A ratio under 1.0 is sometimes considered cause for concern, and the farther under 1.0 an institution falls, the more trouble it will have attracting financing and the less it will be able to handle unexpected financial trouble.

Endowments and payouts. Almost a third of business officers at private baccalaureate colleges (32 percent) said that at least 10 percent of their annual operating budget was supported by revenue from their endowments, and one in six (17 percent) put the figure at 15 percent or more. The mean percentage reported by CBOs at those institutions was 8.4 percent, more than double the 3.8 percent at private doctoral/master's universities and the 3.5 percent at public doctoral institutions.

Perhaps recognizing that that level of support may be unsustainable, 31 percent of CBOs at private baccalaureate colleges said they would lower their payout rate over the next year, while 60 percent said they would keep it the same and 10 percent said they would raise the level. Fewer business officers at private doctoral/master's (18 percent) and public doctoral universities (16 percent) said they would lower the payout rate.

Lack of adequate data. The 2018 survey continued a long-standing pattern of Inside Higher Ed surveys in underscoring college leaders' sense that they don't have the data they need for sound decision making. Asked to respond to the statement "My institution has the data and other information it needs to make informed decisions about" a variety of key judgments, none of the categories drew agreement from a majority of business officers. The closest was on the efficacy of specific academic programs and majors, on which 49 percent of CBOs agreed (only 16 percent strongly). Between 40 and 45 percent of business leaders agreed that they had sufficient data on which academic programs should be eliminated or enhanced, the performance of individual faculty members, and the performance of administrative technology, but fewer than 40 percent agreed on the performance of academic technology and the performance of each administrative unit on campus.

Support for transparency. Notably more business officers this year than last backed the idea that "greater transparency in campus decision making will result in better financial decisions," with the change driven almost entirely by public college CBOs. Sixty-three percent of them agreed, vs. 55 percent last year, with an 11-point swing (34 percent vs. 23 percent) among those strongly agreeing.

Impediments to merging. Asked to select "significant impediments" to a possible merger at their college, "desire to maintain the status quo" was the top choice over all, at 52 percent. But the answers varied significantly by sector: business officers at public master's/baccalaureate universities, for instance, were likeliest to identify faculty opposition (62 percent) as a barrier, and the least likely to say "lack of financial necessity" (22 percent). The top choice of community college CBOs: governing board opposition, at 42 percent. Over all, business officers who lacked confidence in their institution's financial stability over a decade were significantly less likely (26 percent vs. 46 percent) to cite lack of financial necessity as an impediment to merger.