Free Download

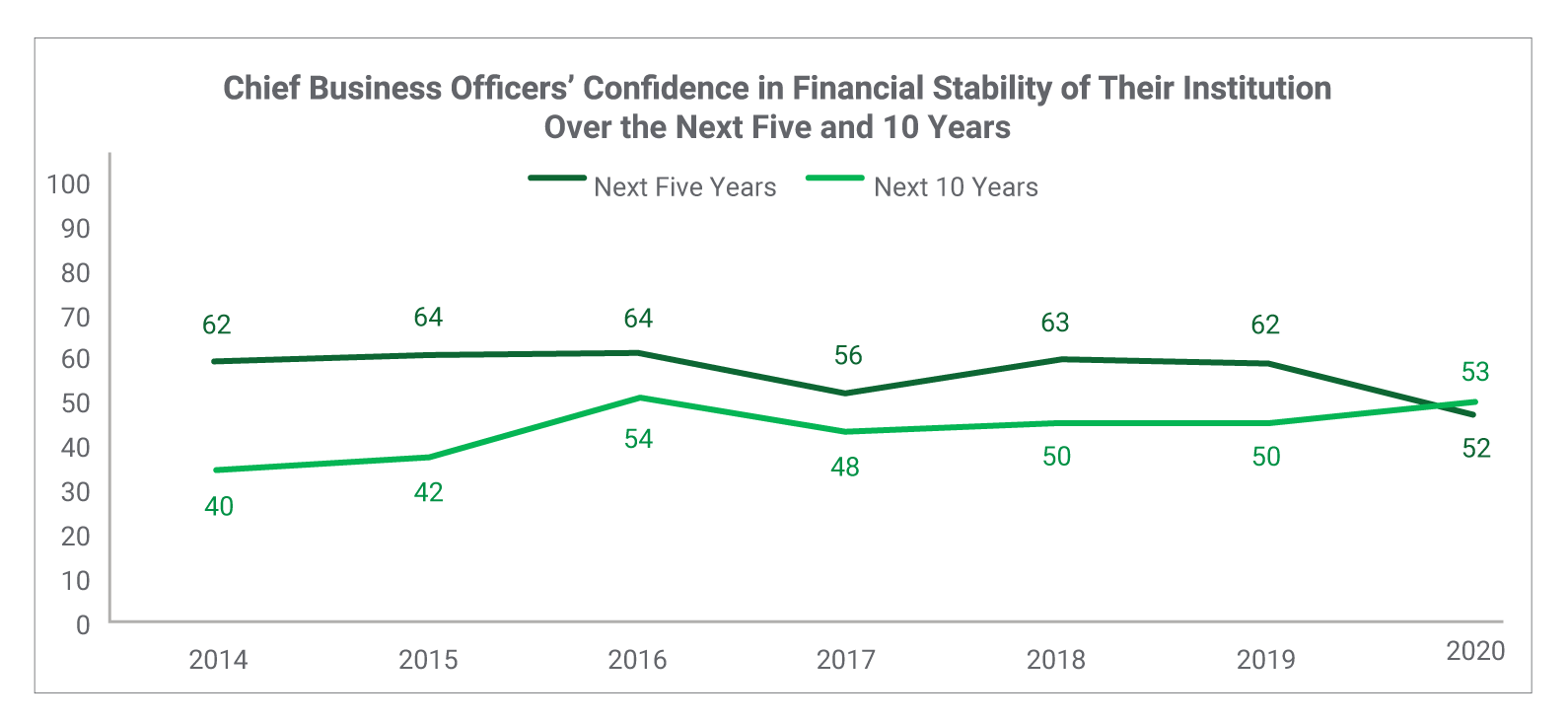

Throughout the decade that Inside Higher Ed has been asking chief business officers how confident they are in their institution's financial stability over five and 10 years, they've historically been quite a bit more confident in the near term than over the longer term. That makes sense, in many ways, given that most business leaders have a clearer line of sight into the next few years than over a decade, when who knows what might happen.

This year is different (is that an understatement or what?). Respondents to this year's Inside Higher Ed Survey of College and University Business Officers were actually slightly likelier to express confidence in their institution's stability over 10 years (53 percent) than over five (52 percent).

That's less because they're suddenly wildly optimistic about their prospects over a decade, though there was a slight uptick from 50 percent in 2019, than because the near term looks a lot murkier. Confidence in the five-year outlook dropped a full 10 percentage points from 62 percent in 2019, with particularly steep drops among business officers at community colleges and private nonprofit doctoral and master's universities.

About the Survey

Inside Higher Ed’s 2020 Survey of College and University Business Officers was conducted in conjunction with researchers from Gallup. You may download a copy of the survey booklet here.

Inside Higher Ed regularly surveys key higher ed professionals on a range of topics.

On Tuesday, Aug. 11, at 2 p.m. Eastern, Inside Higher Ed editors will analyze the survey’s findings and answer readers’ questions in a free webcast. To register, please click here.

The Inside Higher Ed survey of business officers was made possible in part by support from Accenture, Jenzabar, Oracle, Syntellis and TouchNet.

The dip in short-term confidence isn't surprising, given the double-barreled impact of COVID-19 and the ensuing recession on just about every aspect of institutional budgets. While the majority of business officers report that their institutions had generated under $2 million in unanticipated budget costs by the time the survey was conducted in early June, one in five said they had accumulated more than $5 million and one in 10 at least $10 million.

Among other highlights of this year's survey of 271 chief business officers:

- Roughly a quarter or fewer of CBOs said their institution had already furloughed employees, reduced the pay of senior administrators or promoted earlier retirement or voluntary separation for faculty or staff members. But a third or more said they expected to eliminate administrative and adjunct faculty positions and eliminate underperforming academic programs by the end of 2020.

- About a quarter of business officers said they believed their institution could "ride out the current difficulties and return to more or less normal operations" within two years, while nearly half said their institution "should use this period to make difficult but transformative changes in its core structure and operations" in the interest of long-term sustainability.

- Any plans for transformation appear not to involve mergers. Just 5 percent of business officers said senior leaders at their college had had "serious internal discussions" in the last year about merging with another institution, down from 12 percent in 2019 and 17 percent the year before. That's despite the fact that the proportion of CBOs who said they thought their institution should merge rose to 22 percent, up from 18 percent last year. But nearly a third of regional public university business officers said they were open to sharing administrative operations with another institution.

- Colleges' responsiveness to the COVID-19 crisis seemingly enhanced business officers' faith in their institutions' adaptability. About half of them said their institution had the "right mind-set" (56 percent) and the "right tools and processes" (48 percent) to respond quickly to needed changes. In 2019, those figures were 38 and 35 percent, respectively.

The Confidence Meter

Inside Higher Ed revamped its annual business officers' survey to focus almost exclusively on COVID-19 and the recession. But as it does each year, it started out with a temperature check on the officials' overall confidence in their institutions' financial state. The overall results were as described above and seen below: short-term confidence fell sharply.

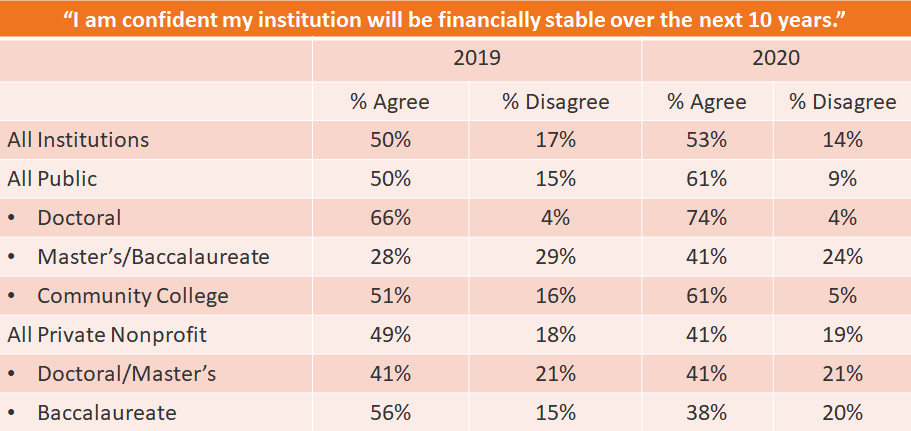

As is always true, different sectors of higher education have varying degrees of confidence in their financial stability, with CBOs at public doctoral institutions most confident by far and those at community colleges next, as seen in the table below.

But the COVID-19-related drop in near-term confidence also varied in intensity: the 61 percent of community college business officers who agreed they were confident in their five-year outlook was 15 percentage points lower than last year's 76 percent, and the 42 percent confidence level of CBOs at private doctoral/master's institutions was down sharply from last year's 55 percent. While the near-term confidence of private baccalaureate colleges' financial leaders was only modestly lower than last year (41 percent versus 45 percent), nearly a quarter of them (24 percent) disagreed that they were confident in their five-year financial stability, three times more than last year's 8 percent.

As a counterpoint, public master's/baccalaureate business officers actually expressed more confidence (albeit at a low level of 42 percent) in their five-year outlook this year than they did last year (37 percent).

The fact that business officers' short-term confidence has taken a hit isn't surprising when one considers the maelstrom their institutions are facing related to COVID-19 and the recession (as we'll explore more below). The slightly increased confidence in the 10-year outlook is harder to explain. Here again, digging deeper than the overall numbers offers a bit of clarification: public college and university business officers across the board have a much rosier decade-long view than do their private college counterparts, with confidence levels rising for all segments of public institutions and dropping sharply for private baccalaureate colleges.

Rick Staisloff, founder and a principal of rpk GROUP, a higher ed consulting firm, said the 10-year confidence figure perplexed him. "Are CBOs thinking that the urgency of the current crisis will lead to needed change, or is this simply a human response of 'it has to get better from here?'" he said via email.

COVID's Financial Pain

COVID-19 and the recession it drove will hurt virtually every college financially, both by imposing unexpected costs and by pinching (or gutting) almost every source of revenue. The revenue picture is likely to remain somewhat unclear until the fall, when we see whether institutions have been able to sustain their enrollments (and the associated tuition and room and board revenue) and avoid major state financial cuts (for public institutions), among other things. Because that situation was in flux at the time of this survey, Inside Higher Ed focused on colleges' costs.

Nearly six in 10 business officers (59 percent) said their institution had spent less than $2 million in "unanticipated budget expenses … related to COVID-19," while about a quarter (23 percent) said they had spent between $2 million and $5 million and 18 percent said they spent more than $5 million.

The numbers look very different by sector, though: community college CBOs overwhelmingly (82 percent) said their institutions had spent less than $2 million, while nearly a third of public doctoral institutions' finance officers (32 percent) reported spending $20 million or more.

Those numbers may seem low, given reports from some leading institutions that they spent many tens of millions of dollars. Campuses are almost certainly spending much more this summer in preparing their campuses for a physical return beyond what they had spent by early June when the survey was conducted.

Respondents were asked a set of questions about actions they had already taken and expected to take in the coming year that could result in expenditures.

More than half said they had already invested "significantly" in software and services (61 percent) and hardware (55 percent) to enable virtual learning, while slightly less than half said they had already restructured their classroom spaces (45 percent) and dining spaces (45 percent) to allow for physical distancing. Under a third said they had restructured their living spaces (29 percent) or adopted keyless/touchless entry to facilities (20 percent). About half of respondents said they were likely to restructure their classroom, dining and student living spaces by the end of 2020.

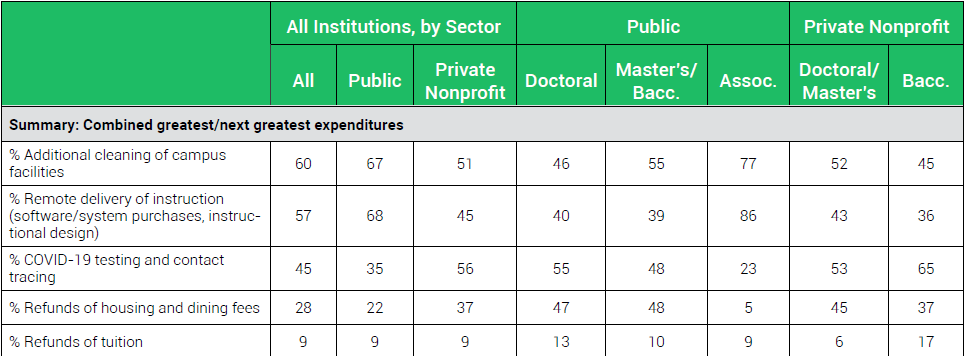

Asked where they expected their greatest additional expenditure of funds in the 2020-21 academic year to come from, business officers cited costs related to cleaning of campus of facilities, remote delivery of instruction and testing and contact tracing.

Those new costs and the near certainty of reduced revenues are likely to force campuses to make difficult decisions about allocating their resources in the coming year. The survey gave business officers a list of 12 possible actions they have taken or might take this year, and the answers offer a guide to which employees and services might be most vulnerable (and are likely safe) if colleges and universities' worst-case budget scenarios come to pass.

CBOs said their institutions had taken few of the actions so far: slowing or stopping capital projects was the only one that a majority of them said they had taken (55 percent), while between a quarter and a third said they had eliminated administrative positions (31 percent), furloughed employees and reduced the pay of senior administrators (27 percent each), and eliminated adjunct faculty positions (26 percent). Fewer said they had taken steps such as promoting early retirement for faculty members (24 percent) or administrators and staff (18 percent), reducing retirement benefits (14 percent) or faculty and staff pay (13 percent), eliminating underperforming academic programs (12 percent), drawing down exceptionally from their endowments (9 percent), or reducing health-care benefits (4 percent).

Business officers' answers about what they are likely to do (and not do) by the end of 2020 suggests they will prioritize the jobs, pay and benefits of faculty and staff members (except, as is almost always the case, of adjunct instructors) and take a scalpel to administrative positions and underperforming academic programs.

At least a third of business officers said they were likely in 2020 to eliminate adjunct positions (40 percent), underperforming academic programs (40 percent) and administrative positions (36 percent), while roughly three in 10 said they expected to furlough employees (30 percent) or promote early retirement or voluntary separation for faculty members (31 percent) or administrators and staff (29 percent).

Half or more of the business officers said they were not likely to do the following before the end of 2020:

- Reduce health-care benefits (84 percent)

- Take an unscheduled or larger-than-planned draw from their endowment (76 percent)

- Reduce faculty and staff pay (70 percent)

- Reduce retirement benefits (66 percent)

- Promote early retirement/voluntary separation for administrators and staff (53 percent)

Two other questions asked business officers to step back from the crisis thinking of the current moment to consider potentially longer-term strategic shifts.

One was more philosophical, asking CBOs to describe their institution post-COVID and the recession as returning to normal, shrinking, resetting for growth or being transformed. The largest proportion, 47 percent, chose the latter, while a hoped-for return to normal was next.

"It is encouraging to see almost half of CBOs feeling that this can be a moment of transformative change in higher education," Staisloff said. "Of course, many of us thought the Great Recession would lead to change as well, but higher education largely went back to its old ways and spent more year after year. If transformation is going to happen, it will require more than just financial pressure -- the culture of higher education will need to change."

What might that change look like practically? The survey asked business officers whether their institutions were "seriously contemplating taking" a set of actions over a slightly longer term, the next 12 months. These were less about cost savings, necessarily, than the embrace of new strategies and directions.

More than half said they were contemplating "revamping [their] academic calendar to provide more flexibility" (61 percent) and increasing the number of employees who permanently work remotely (52 percent). About a third said they might reduce their contributions to deferred maintenance, increase their faculty teaching load (33 percent) and increase their student-faculty ratio (32 percent). About one in five said they could abandon existing plans for new facilities (21 percent) or share administrative operations with another institution (19 percent). And few said they would consider combining academic programs with another college (8 percent) or revise their tenure policies (4 percent).

Public master's and baccalaureate institutions, which in recent years have been under particular financial strain (along with many small private colleges), were likelier than their peers to be contemplating many of these changes: nearly two-thirds said they were contemplating increasing the faculty teaching load, nearly double the average for all institutions, and 34 percent said they would seriously consider sharing administrative operations with other institutions.

Community colleges, by contrast, were less likely than other institutions to be considering eight of the nine strategies on the list.

The Current Situation's Impact on Other Issues

The global pandemic and recession appear to have influenced business officers' thinking about elements of campus operations that go well beyond their immediate financial and strategic approaches.

For instance, the survey asked business officers a set of questions from past questionnaires about their governance and decision-making frameworks -- and the results suggest that these crises have heartened them.

More than half of CBOs, 52 percent, "strongly agreed" that trustees "are aware of and understand the financial challenges" confronting the institution, up from 35 percent in 2019. Sixty-three percent of business leaders said the same about senior administrators at their college or university, up from 53 percent last year.

Similarly, 56 percent of financial officers agreed (21 percent strongly) that their college has the "right mind-set to respond quickly to needed changes," up from 38 percent (9 percent strongly) a year ago. And 48 percent agreed or strongly agreed that the institution has the "right tools and processes" to shift gears fast; 35 percent answered that way in 2019, and 29 percent disagreed, a figure that fell to 15 percent this year.

Only about a quarter of business officers (26 percent) see their institution's governance structure or a "lack of data or analytic capacity" as significant obstacles to a sustainable financial future.

But 40 percent -- including 54 percent at regional public institutions and 55 percent at private baccalaureate colleges -- say a "lack of resources for investment" is an obstacle.

And while CBOs generally say their leaders have stepped up amid the crises in play, they do not feel that way about another key campus constituency. Only 34 percent of business leaders say their campus's faculty members "are aware of and understand the financial challenges" confronting the institution, barely unchanged from 2019.

It might be tempting, as many administrators do, to blame faculty members for their perceived failure to get it. But Susan Whealler Johnston, president and CEO of the National Association of College and University Business Officers, put the responsibility on financial administrators, too, for any failure to comprehend the magnitude of the current situation.

"Although not new, this tension demonstrates the opportunity to improve the dissemination, interpretation and communication of financial information between faculty and business officers," Johnston said.

Mergers

Many college leaders see the prospect of merger with another institution as a last resort, since such combinations typically result in one institution absorbing another -- and who wants to be the president who made their college disappear? So even at their perceived peak, two or three years ago, fewer than one in five business officers said mergers were on the table at their college.

Far fewer say so now: just 5 percent of all business officers, including a high of 12 percent of regional public university CBOs, say senior leaders at their institution had discussed a merger in the last year. Roughly the same proportion said their institution was likely to merge into another institution within five years, although nearly four times that many, 22 percent, said their institution should merge with another college in the next five years.

While there were not major differences by sector on the "should merge" question, with the exception of a low of 7 percent among public doctoral institutions, CBOs in the Northeast were significantly likelier (33 percent) than those elsewhere to say their institution should merge with another, as were those who said they were not confident in their institution's five-year financial outlook (31 percent versus 14 percent of those who were confident).

Staisloff, of rpk, said he was surprised the current financial crisis hadn't accelerated interest in "exploring mergers, or even consortiums, between institutions … The biggest mistake institutions make around possible mergers is waiting too long."

Endowments

About three-quarters of CBOs said their institution's operating budget was at least partially supported by endowment revenue. Of those, about three-quarters said they expected to keep their endowment payout rate steady in the next year, while 19 percent expected to increase it and 9 percent planned to lower it.

Business officers at public doctoral universities were far likelier to lower their payout (21 percent) than raise it (0 percent), while those at private baccalaureate colleges were much more likely to increase the payout (43 percent) than lower it (7 percent).

CBOs at private four-year colleges were also much more likely (34 percent) than those at peer institutions (21 percent of all respondents) to say they took more money than planned out of their endowment in the last 12 months, and to say that they expected to do so in the next 12 months (51 percent versus 27 percent of all institutions).

In a survey that contained quite a few findings indicating anxiety and financial strain for colleges, that result was a reassuring one, Staisloff said.

"It’s encouraging to see the overwhelming majority of respondents indicate that they will not be tapping the endowment as a funding source," he said. "The risk seems too great that those funds would be used to prop up unsustainable models, rather than as investments toward transformation."