You have /5 articles left.

Sign up for a free account or log in.

President Biden’s latest plan to forgive student loans is facing a legal challenge, even though it’s not yet final.

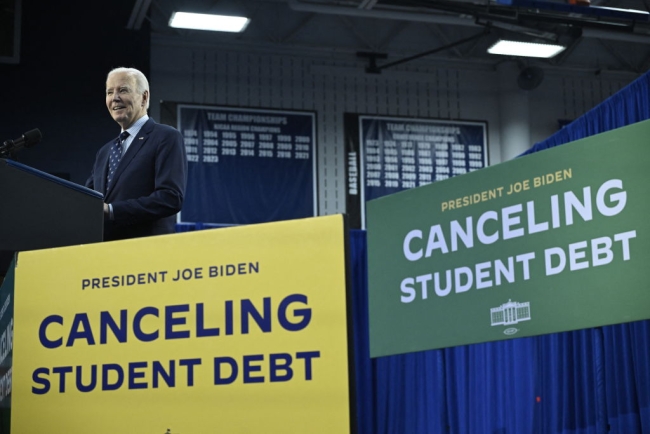

Andrew Caballero-Reynolds/AFP via Getty Images

A new lawsuit claims that the Biden administration will start discharging billions in student loans this week as a part of sweeping plan to provide debt relief for nearly 28 million Americans.

Missouri, represented by Attorney General Andrew Bailey, and six other Republican-led states filed suit Tuesday to stop the plan before it takes effect. They argue that the education secretary is “unlawfully trying to mass cancel hundreds of billions of dollars of loans” and planning to do so by Sept. 7. The states asked a federal judge in Georgia to temporarily restrain the Education Department from moving forward with its plans to forgive loans.

“Through cloak and dagger, the department has thus finalized a rule with a rollout plan that is maximally designed to forgive tens or hundreds of billions of dollars without any judicial review and is designed to boost the incumbent Democratic presidential candidate two months before the election,” the lawsuit argues.

But the department hasn’t issued the final regulations, which would provide a pathway to loan forgiveness for groups of borrowers including those who have been repaying their loans for more than 20 years and others whose college programs failed to deliver sufficient financial value. That step is expected soon, though, and the department does intend to automatically forgive loans under the plan as soon as possible after finalizing the rule.

The Education Department declined to comment directly on the lawsuit or say when it plans to issue the final rule, which was still under review at the Office of Management and Budget as of Wednesday afternoon.

“The department remains committed to supporting borrowers and fighting for affordable repayment options and relief for those who qualify,” a spokesperson said. “We will continue to follow the law as we work to prepare for possible debt relief this fall, which would only be implemented after the proposed rules first introduced this spring are finalized.”

This is the third time that Republican-led states have challenged the Biden administration’s efforts to forgive student loans, and so far, they have found success. After the first lawsuit, the Supreme Court in June 2023 struck down a plan to forgive up to $20,000 in student loans for eligible Americans. About 43 million Americans were expected to benefit from that plan.

They may be throwing spaghetti at the wall to see what sticks, but my office is meeting them every step of the way.”

—Andrew Bailey, Missouri attorney general

And then this summer, the states won a nationwide preliminary injunction blocking the Biden administration’s revised loan repayment plan, which Republicans argue is another attempt at mass loan forgiveness. The court order puts the plan on hold while litigation continues.

“We successfully halted their first two illegal student loan cancellation schemes; I have no doubt we will secure yet another win to block the third one,” Bailey said in a statement. “They may be throwing spaghetti at the wall to see what sticks, but my office is meeting them every step of the way.”

The lawsuit repeats many of the arguments used in previous legal challenges against President Biden’s efforts to forgive student loans. The states allege that the plan exceeds the department’s legal authority and would harm the states’ bottom lines as well as those of state-created entities that manage federal student loans, such as the Higher Education Loan Authority of the State of Missouri (MOHELA).

What’s different about this lawsuit is the push to pre-emptively block the Biden administration from taking any action. The states say they need to act quickly because federal judges have previously ruled that they “cannot turn back the clock on any loans that have already been forgiven.”

As a result, the states say, “it does not matter how many rules [the education secretary] breaks in the process, so long as he forgives billions of dollars in debt before the courts stop him. This court should not permit that brazenly lawless action to continue.”

Administration officials began working on the plan after the Supreme Court struck down Biden’s initial attempt to forgive billions in loans. Under this new iteration, which relies on a different legal authority, borrowers could see some or all of their balances wiped out if they meet certain eligibility criteria.

Those who owe more than they initially borrowed would automatically get up to $20,000 of interest forgiven. Low-income borrowers, as well as those enrolled in an income-driven repayment plan, could see all of their accrued interest canceled. Single borrowers who earn $120,000 or less, along with married borrowers whose families earn $240,000 or less, would be eligible for full interest cancellation.

Forgiving interest is the costliest part of the plan and would benefit 26 million borrowers. The department has said that aspect would cost $62 billion over 10 years. The states claim in their suit that it would cost $73 billion but don’t provide a citation for that figure. The price tag for the total plan is an estimated $147 billion over a decade, per the department.

‘Apex of Arrogance’

Although it hasn’t finalized the regulations, the department has indeed been preparing to roll out the plan, according to documents obtained by the states. The documents show that officials have been working with federal loan servicers on the logistics involved with discharging the loans—answering questions about which borrowers are eligible and drafting emails to notify borrowers about the relief. The department wants to fully carry out the debt relief by Sept. 20, according to the lawsuit.

The department allegedly told loan servicers to report balances of all loans and fix any errors by Sept. 6. “At that point, the Department will submit ‘forgiveness files’ to the contractors, which the contractors are instructed to process ‘immediately upon receipt,’” the complainants say.

The department told borrowers on Aug. 1 that they had until the end of the month to opt out of any relief—a move that both critics and supporters of debt relief interpreted as a sign that the agency would move quickly to provide relief once the rule is finalized.

“Defendants’ unusual decision to ask people to confirm whether they want to opt out of a program before it is even published created concern that defendants are planning to unlawfully rush out the third mass cancellation rule to cancel as much debt as possible, creating a fait accompli before anybody has time to challenge the action,” the states wrote in the lawsuit.

Representative Virginia Foxx, the North Carolina Republican who chairs the House education committee, told the department in a mid-August letter that no administration, to her knowledge, “has ever taken such an aberrant approach to the administration of federal student aid as auto-enrolling the public in a government program that does not yet exist.” When she sought more information about the department’s plans, she didn’t get clear answers, Foxx said.

“The apex of arrogance,” Foxx wrote in her letter, “would be to publish a regulation with immediate effect and wipe tens of billions of dollars in loans off the books overnight, only to have a court likely halt the rule and reverse the accounting. Borrowers deserve to be spared the mass confusion that would ensue if the Department stooped to this level of disregard for the rule of law.”