You have /5 articles left.

Sign up for a free account or log in.

The University of California, Berkeley, campus

Justin Sullivan/Staff/Getty Images

As NFTs dominate the moment, some colleges are cashing in on the craze.

An NFT—short for nonfungible token—is a speculative, digital asset that is unique and cannot be replicated or replaced. People often compare NFTs to original works of art; while many people own prints or replicas of the Mona Lisa, Leonardo da Vinci’s original painting hangs in the Louvre. Also like art, an NFT’s value depends on how many other people would pay to own it, and how much they would pay.

In June, the University of California, Berkeley, auctioned an NFT based on the Nobel Prize–winning research of immunologist James Allison, who helped establish immunotherapy as a fourth pillar of cancer treatment. It netted the university about $50,000.

Berkeley announced months ago that it would auction a second NFT based on Jennifer Doudna’s Nobel Prize–winning CRISPR-Cas9 gene editing invention, but it has since put those plans on hold. Creating the NFT was legally complicated, said Richard Lyons, chief innovation and entrepreneurship officer at the university. Nevertheless, the university is pursuing other NFT auctions.

“We have another NFT teed up that involves a breakthrough that bears directly on blockchain technology, which should appeal especially to this collector audience,” Lyons said. “We are also pursuing a possible line of NFTs around UC Berkeley’s creative works.”

Berkeley auctioned the NFT via Foundation, an online marketplace for NFTs. Using an existing platform like this one is a good way for colleges and universities to experiment with NFT auctions, said Jeremy Coffey, a senior associate attorney at Perlman and Perlman who counsels nonprofits on digital currency and new fundraising platforms.

“The barrier is relatively low for organizations that just want to try to leverage NFTs,” he said. “In my experience, most organizations have tried one-off fundraisers to see how it goes and to see whether there’s any interest.”

“The barrier is relatively low for organizations that just want to try to leverage NFTs,” he said. “In my experience, most organizations have tried one-off fundraisers to see how it goes and to see whether there’s any interest.”

Alex Wilson, co-founder of the Giving Block, an organization that works with nonprofits on cryptocurrency fundraising, explained how an NFT auction works.

“If someone has an NFT, they can essentially list it for sale on a marketplace. In most cases, they’re selling those NFTs for cryptocurrency,” Wilson said. “So someone will place a bid, much like they would for traditional art. If they win, the buyer is going to use crypto to pay for it, and the seller is going to get crypto in the [digital] wallet that they have attached to the NFT.”

Oftentimes, the seller will donate the proceeds after the sale is complete.

“NFT philanthropy has really taken off this year,” Wilson said. The Giving Block has facilitated more than $10 million in cryptocurrency donations that resulted from NFT sales in 2021.

Even if institutions are hesitant about creating and selling NFTs themselves, they should still be aware of how the transactions work and be ready to accept cryptocurrency donations that result from NFT sales, Wilson said.

“For a lot of nonprofits, they might see crypto come in and not always connect the dots, but it was actually the result of an NFT sale,” he said.

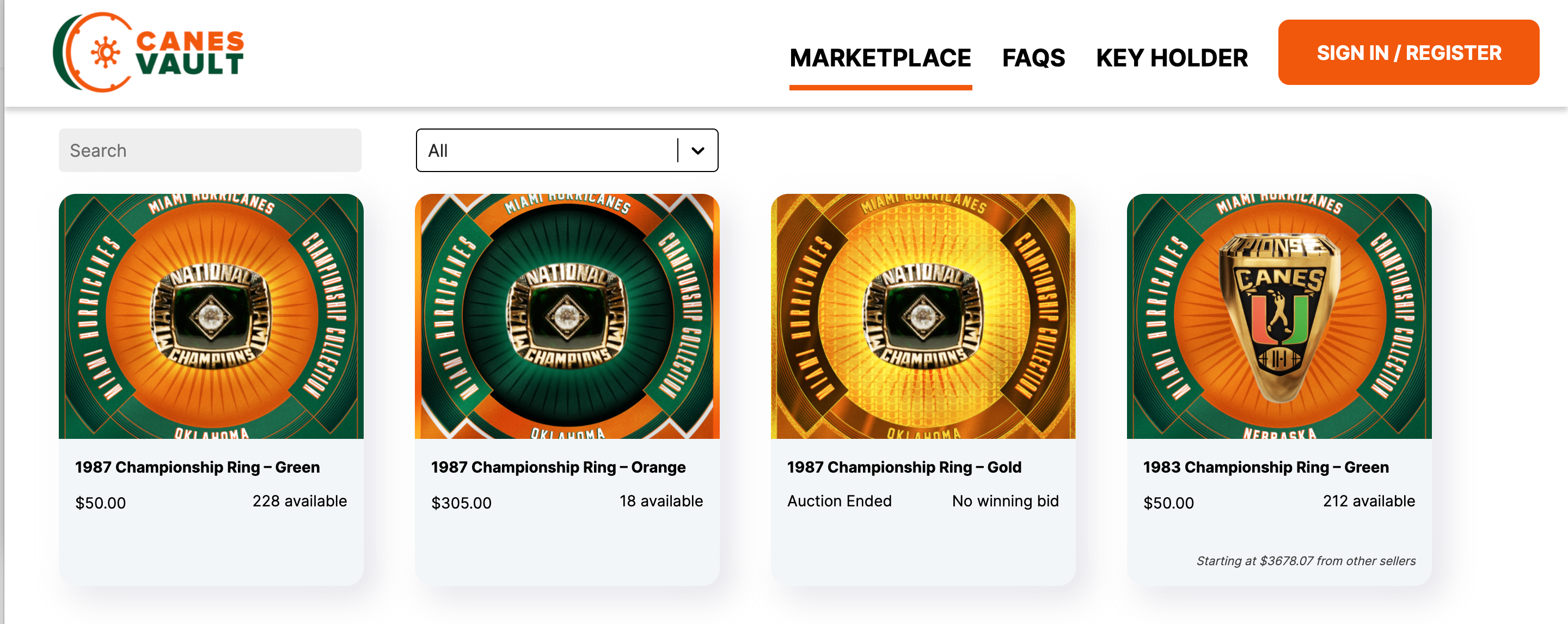

The University of Miami took a different approach when it auctioned its first NFT in August. The university created canesvault.com, a university-specific NFT marketplace named for the Hurricanes football team, to auction an NFT of the team’s 1989 championship ring. The NFT—which included a replica ring and looping digital graphic of the ring—sold for $10,000.

Miami now lists a few dozen digital championship rings, commemorative tickets and other NFTs on canesvault.com at a variety of price points, from $50 to more than $2,000. Some of the other auctioned NFTs have sold for more than $5,000 each.

NFTs open up a world of possibilities for university fundraisers. Essentially, any valuable university asset could be turned into an NFT and sold to the highest bidder. The only assets that are likely off-limits for an NFT sale are those with naming rights attached, according to Coffey.

“Those assets are probably no longer available to be turned into NFTs in any way without the consent of the original donors who hold the naming rights,” he said.

Creating a nonfungible token—a process called minting—is extremely energy intensive. Critics of the digital assets have sounded alarms about the environmental impact of the tokens.

To help counter the energy cost of creating its NFT, Berkeley spent 10 percent of its profit—or $5,000—on carbon offsets.

“The best estimates we could produce for the direct impact of the first-sale process were quite low, in the $10 to $20 range,” Lyons said. But the university picked $5,000—a conservative figure—to account for future transactions of the NFT and potential developments in blockchain technology that make those transactions more energy efficient.

NFTs likely won’t be around forever, Coffey said. “But they are certainly a potential source of revenue right now.”