You have /5 articles left.

Sign up for a free account or log in.

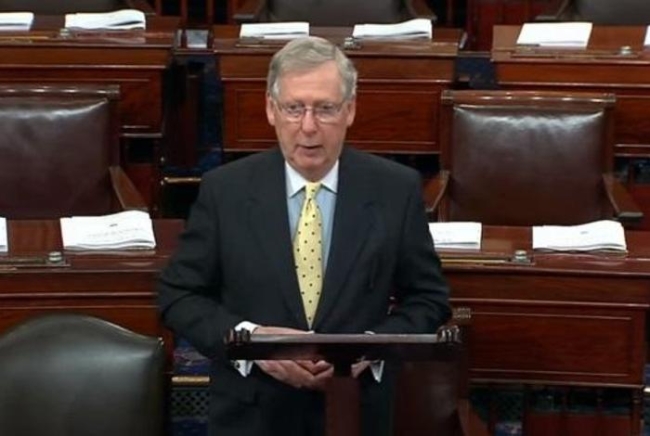

Senate Majority Leader Mitch McConnell speaks on the Senate floor about attempts to craft a coronavirus response stimulus package.

Senator Mitch McConnell

Even though Senate Republicans and President Trump are reportedly considering legislation that would send many Americans $2,000 as part of a new coronavirus stimulus package, advocacy groups say those struggling with student loans need more significant help weathering the economic fallout of the crisis.

The advocates suggest measures such as allowing students to defer loan payments. And indeed, Senate Democrats propose the federal government go further and cover student loan payments for financially distressed borrowers.

The suggestions are emerging as lawmakers discuss what to include in a new stimulus package, even as the Senate on Wednesday approved the $100 billion measure passed by the House Saturday to require insurers and government health-care programs to provide free coronavirus testing to those who need it and to pay for a new requirement that the federal government and small businesses provide up to two weeks of paid sick leave for employees who fall ill from the virus.

But speaking on the Senate floor Wednesday, Republican Senate Majority Leader Mitch McConnell said that bill “has real shortcomings. It does not begin to even cover all of the Americans who will need help in the days ahead.”

Lawmakers crafting the new stimulus package are hoping to have it ready as early as next week.

The idea of sending people direct payments is being discussed as part of that effort. Senate Republicans and Trump have said that the new measure will be substantially larger, perhaps a $1 trillion package. Lobbyists familiar with the discussions of what will be in that package describe them as “fluid.”

Politico on Wednesday reported that Republican education committee chairman Lamar Alexander briefed Republican senators on the idea of deferring student loan repayments for as much as three months, but spokesmen for Alexander and McConnell did not give further details of what's being considered.

That would come on top of Trump's announcement last week that he will be waiving the interest on federal student loans. However, student aid experts have said it doesn’t appear that the proposal would lower how much borrowers have to repay each month. Some of those borrowers may be dealing with job losses and reduced incomes as states and cities order the closure of restaurants and other businesses to contain the spread of the virus.

A short-term break from monthly payments would likely be acceptable to right-leaning policy experts, “at least, as long as it is deferment and not some sort of forgiveness,” said Neal McCluskey, director of the conservative Cato Institute’s Center for Educational Freedom.

"A lot of people may struggle to repay through no fault of their own -- and wonks on the right, I think, see a big upside, with no long-term downside, as long as the loans are eventually repaid," he said. "It is a reasonable accommodation while many people are essentially forced out of work in order to slow the spread of the disease."

But “forgiveness,” he said, “is not warranted, especially since many people with debt are still working and some in very lucrative fields. But during an emergency it is reasonable to make fast and broad decisions as long as they are temporary.”

In contrast, Inside Higher Ed learned Tuesday that the stimulus package put together by Senate Democrats would go further than a three-month deferment. It would not only defer monthly payments, but pay down the amounts owed -- an idea advocated by Senator Elizabeth Warren, a Massachusetts Democrat.

Democrats have not made the details of their plan public. Speaking on the Senate floor Monday, Democratic Senate Minority Leader Chuck Schumer said only, “Our proposal will let you defer your mortgage loans for six months. No penalty, fees or impact on your credit. We'll do the same for student loans.”

But according to a PowerPoint presentation about the proposal distributed to Democratic senators this week, the plan would “Cancel Monthly Student Payments and Have Federal Government Pay,” raising the question of whether federal dollars would go toward paying down borrowers' loans.

Schumer’s office on Wednesday confirmed Democrats are proposing to pay down borrowers' debt.

“Our proposal would work in concert with the president’s directive to waive student loan interest. So our payments would in effect be directly toward the principal balance.”

Whether it will be included as part of a final package is unknown. Spokesmen for McConnell and Alexander declined to comment on the idea.

Meanwhile, advocacy groups pushed for some breaks for borrowers, on top of the direct payments.

If the purpose of sending direct payments is to stimulate the economy, then it won't do much good if struggling borrowers use a lot of it just to make loan payments, said Wesley Whistle, senior adviser for policy and strategy at New America, a left-of-center Washington think tank. But temporarily excusing borrowers from making student loan payments “ensures the borrower's direct payment isn't used up on their loans and can provide more relief or stimulus,” he said.

The Democratic plan, he said, would mean borrowers “will not only be relieved of payments but will see their balances go down. And with the interest waiver, borrowers would actually make more progress towards their loans than if they were making their payments otherwise.”

James Kvaal, president of the Institute for College Access & Success, also called for relief aimed at student loan borrowers.

"It’s critical to provide student loan payment relief regardless of additional stimulus proposals such as cash payments,” he said in a statement.

“Going through the work of sending direct checks to people only to have it go to student loan payments will undercut the purposes. Now is the time to focus on immediate expenses. Student loan payments can and should wait,” said Ben Miller, senior director for postsecondary education at the Center for American Progress, a liberal think tank in Washington.

Bob Shireman, director of higher education excellence and a senior fellow at the Century Foundation, a progressive think tank, said that the federal government making borrowers' loan payments is workable administratively and “It is a good approach.”

However, he and even supporters of the Senate Democrats' plan such as Miller, said the federal government making payments for borrowers raises questions of fairness. That's because it would disproportionately help people making large monthly payments. On the other hand, “those who have had difficulty paying are making lower payments on income-driven repayment or other longer repayment timelines,” Shireman noted.

Miller agreed. “Any proposal to make payments on behalf of borrowers needs to contain provisions so lower-balance borrowers don’t get disproportionately smaller benefits,” he said.