You have /5 articles left.

Sign up for a free account or log in.

Senator Michael Bennet

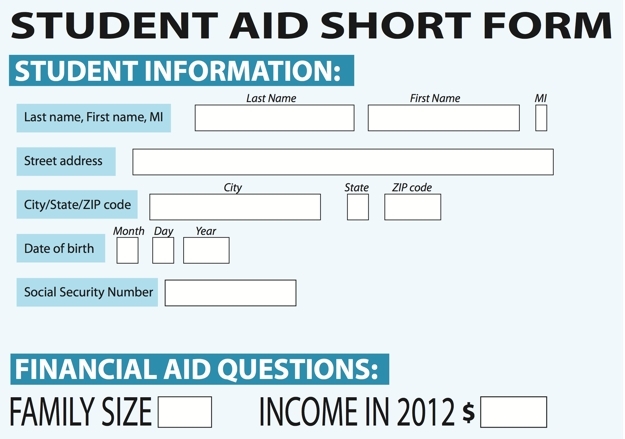

It seems, all of a sudden, that there’s a rush among policy makers in Washington to chop off questions from the 108-question Free Application for Federal Student Aid, known as the FAFSA.

Senator Lamar Alexander, who has been beating the FAFSA simplification drum for several years, has said that the Senate education committee he chairs will take up his bipartisan bill for a two-question aid application this spring.

And last month President Obama put out his own proposal for cutting 30 questions from the form, reviving a 2009 proposal by his administration to eliminate complicated questions relating to families’ business assets and investments, among other things. The agreement on FAFSA simplification reflects a consensus among many that the complex questionnaire scares some families off -- and that a simple form would boost enrollments of low-income students.

But many colleges and states want to put the brakes on the race to eliminate as many FAFSA questions as possible. Although they support the goal of making it easier for students to apply for aid, they’re concerned that cutting off too many questions from the form would make it harder to determine which students are actually in need of student aid.

They argue that FAFSA simplification that goes too far wouldn’t result in any net reduction in burden on families and students. Even if the federal government doesn’t ask some questions about a family’s financial circumstances, colleges and state grant agencies say they still need to collect that information to dole out institutional and state aid.

Justin Draeger, president of the National Association of Student Financial Aid Administrators, said that colleges worry that eliminating too many questions on the FAFSA will give them a less precise understanding of their students’ financial capacity.

The issue will be discussed Friday on "This Week," Inside Higher Ed's free news podcast. Sign up here to be notified of new "This Week" podcasts.

“We have a limited pool of funds, and you’re taking a pool of applicants and trying to figure out the relative financial strengths to each other,” Draeger said. “The less information you gather, the more everybody looks needy on paper.”

Colleges, especially those that award large sums of institutional aid, generally want to know about a family’s financial assets as well as their true income, Draeger said. For example, relying only on adjusted gross income, as the simplification proposals would do, could significantly understate a family’s actual ability to pay for college if they wrote down large amounts of offsetting capital losses. The fear, in short, is that some families of means could appear needy on paper and therefore qualify for aid.

Alexander, a former Secretary of Education, and Obama personally discussed simplifying the FAFSA form last month on Air Force One en route to a Tennessee event announcing the administration’s free community college proposal. Both have cited aid simplification as an area on which they want to work together.

The Obama administration, in its first few months in office, called for a complete elimination of the FAFSA, to be replaced by a single check-mark box on federal tax forms. It hasn’t gone that far, but over the past several years the Education Department has taken some steps to make it easier to fill out the form, allowing applicants to automatically skip certain questions that are irrelevant for them and import their existing tax information that the Internal Revenue Service already has.

Obama’s current proposal, a version of which his administration previously proposed, would cut about 30 questions from the FAFSA. Alexander's plan would ask students to report only their income and family size.

For Alexander, the push to make the FAFSA as simple as a two-question “postcard” is part of a broader higher education agenda aimed at rooting out regulations and red tape that he says are burdening colleges and students.

But the FAFSA form might be a case study in how challenging it is -- practically and politically -- to roll back regulations in higher education. Each federal requirement or question on the form is often backed by a constituency that pushed for it in the first place and doesn’t want to part with it.

Like colleges, state grant agencies are also concerned about getting rid of key data points they use to determine eligibility for state awards.

“If you oversimplify too much, you aren’t really simplifying that much, because families will have to fill out a state form as well,” said Frank Ballmann, who directs the Washington office of the National Association of State Student Grant and Aid Programs.

Among the FAFSA data points that nearly all state grant agencies want to keep are: length of residency in the state, length of program, degree or program for which a student is applying and which colleges a student lists on the form (so they can anticipate whether a student might be eligible for a grant).

Most states, nearly 90 percent of them, rely on the estimated family contribution that the federal government calculates based on the FAFSA form, according to Ballmann. About one-third of states rely on asset-related questions, and 25 percent of states use the data collected about business income, he said.

Prior-Prior Year Push

Rather than cutting down the number of questions on the current Fafsa form, some colleges and advocacy groups want the Obama administration to focus on another simplification effort.

A wide-ranging coalition of groups representing colleges, think tanks and advocacy groups is pushing the Obama administration to adopt “prior-prior year” on the FAFSA. Students and families are currently required to use the previous year’s tax information when filling out the FAFSA, which can create timing obstacles when aid applications are due in January or February but families haven't filled out their annual income taxes.

Under Secretary of Education Ted Mitchell said in a brief interview last week that he supports changing the FAFSA to allow for prior-prior year data.

Mitchell said he thinks it's "not a matter of whether to do it but when" the department would be able to make the change. Although the department has the ability to switch to “prior-prior year” data without Congressional approval, it needs to resolve the policy’s impact on the budget, Mitchell said.

The administration’s budget request released this month does not propose or contemplate such a change.

Mitchell also said that the department is looking at ways it can pare back some questions on the FAFSA form even without new legislation to overhaul it.