You have /5 articles left.

Sign up for a free account or log in.

Update: The Education Department released its proposed “gainful employment” rule this morning. See the bottom of this article for updates.

This morning the Obama Administration plans to release its eagerly awaited "gainful employment" standards for vocational programs at for-profit institutions and community colleges.

The overall structure of the proposed regulations looks the same as a draft version the U.S. Department of Education released in December, according to an embargoed news release the White House circulated on Thursday evening. But many details about the complex metrics were not available before the scheduled 7 a.m. release of the rule’s language.

About 8,000 academic programs would be required to comply with the standards, federal officials told reporters in a conference call Thursday. Those programs enroll one million students.

“Most will pass,” said Arne Duncan, the education secretary. “Many programs, particularly those at for-profits, will not.”

An estimated 16 percent of all covered programs would fail under the proposed new gainful employment metrics, officials said. An additional 8 percent would fall in a warning “zone.” Among for-profits, Duncan said roughly 20 percent would fail and 10 percent would be in the zone.

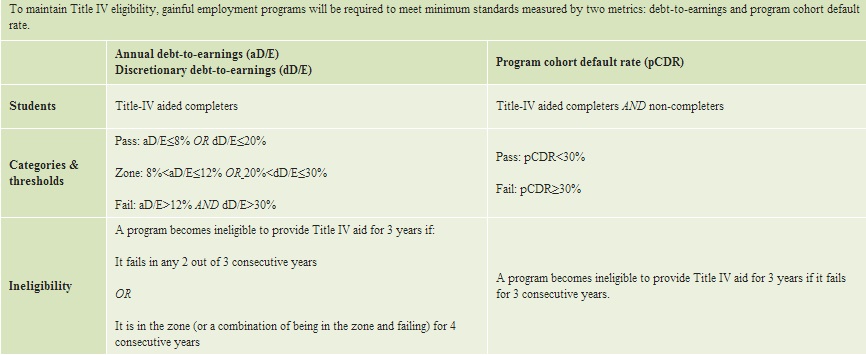

The standards include two metrics (see graphic), with thresholds and requirements that are apparently the same as those unveiled in the December draft.

Programs would fail the debt-to-earnings standard if graduates who qualified for federal aid spend more than 12 percent of their annual earnings on student debt, or more than 30 percent of their discretionary earnings. Those in the zone would fall between failing and the passing standard of 8 percent annual and 20 percent discretionary.

The other metric is a programmatic student loan cohort default rate of 30 percent. That standard is the same as the statutory rate for institutions that the U.S. Congress has established.

The gainful employment rules would also require programs to meet applicable accreditation requirements and state or federal licensure standards, according to the news release. And institutions must publicly disclose information about those programs' cost, debt and student outcomes.

On the call with reporters, officials said the changes in the two metrics since their last iteration were mostly mechanical calculations and largely in the weeds, such as how to calculate amortized debt levels. However, those details mean a lot to both advocates for the for-profit sector and its critics.

The final rule will be several hundred pages long. The fine lines in the regulations are certain to be argued over, and could be part of a legal challenge that many expect the for-profit industry’s primary trade group to file.

A federal judge in 2012 struck down a previous attempt by the Obama administration to create gainful employment standards. The judge ruled that the department’s metric for a minimum loan repayment rate had been set arbitrarily. But he also said the feds were within their overall authority with the approach to gainful employment.

As in the December draft, the proposed rules no longer include a loan repayment rate, which was replaced by the cohort default rate. James Kvaal, deputy director of the president’s domestic policy council, said during Thursday's call that the use of that metric is “well founded” thanks to two decades of the federal government requiring minimum institutional cohort default levels.

“The repayment rate was a new measure, invented by the department,” he said.

As a result there is less legal vulnerability under the new approach, according to Kvaal. “We feel much more comfortable with it.”

There are three overall changes this time around as compared to the 2011 version of gainful employment, Duncan said. The debt-to-earnings thresholds are stricter, include the zone, and allow failing programs to be ineligible for a shorter period of time. Programs must also pass both metrics, which is a change from 2011. And the disclosure requirements are new.

In addition, the proposed regulations provide more opportunities for improvement by programs that are not among the worst performers, federal officials said.

The public will have 60 days to comment on the proposed rule once the Education Department publishes it in the Federal Register, which should be this morning. After the public comment period, the department has another two months or so to further tweak the rules, sources said.

The department will then send any revisions to the White House Office of Management and Budget for review. For the regulations to take effect by July of next year, the feds must publish their final version by Oct. 30. Institutions would be subject to sanctions under gainful employment in 2016, Duncan said.

For-profits and their advocates are certain to push back hard on whatever emerges in the language today.

The Association of Private Sector Colleges and Universities this week wrote to Duncan to express concern about the still-emerging proposal and the process leading up to its creation. The association said the department’s approach to gainful employment lacks statutory authority and also fails to fully analyze the regulations’ impact on underserved student populations.

The department’s focus on for-profits, the letter said, “irrationally and unlawfully favors traditional public and nonprofit institutions, many of which have programs that would likely lose Title IV eligibility were they subject to the same regulatory scheme.”

Duncan wasn’t buying that argument in the Thursday call with reporters. He was withering in his criticism of some for-profit institutions, which he said are selling both students and taxpayers short.

“Widespread evidence of waste, fraud and abuse” among for-profits prompted the Obama administration to begin its multiyear negotiation with higher education over gainful employment, Duncan said. “Too many of these programs fail to provide students with the training they need.”

Duncan also signaled that the White House would continue to pursue policies related to student veterans. He mentioned that revenue from the Post-9/11 GI Bill is not factored into a requirement that less than 90 percent of for-profits’ total budgets come from federal sources.

“These institutions are basically taxpayer-funded,” Duncan said.

***

Update (10:15 a.m.): The Education Department this morning sent the 841-page gainful employment rule to the Office of the Federal Register. The document includes details on how the regulations' two metrics will be calculated. Ben Miller, a senior policy analyst with the New America Foundation and former department official, identified several changes the department made in comparison to a draft version from December.

On the debt-to-earnings ratio, the median debt load will be amortized over a period of 10, 15 or 20 years, depending on the type of academic program, according to the rules. The rate will be calculated using the current interest rate on unsubsidized federal loans.

Median debt levels in the metric will include only debt that is attributable to tuition and fees plus total allowances for books, supplies and equipment.

Programs will fall under the debt-to-earnings requirement if more than 30 students complete each year in the appropriate cohort, the document said. That was increased from a minimum program size of 10 in the previously released draft.

In addition, failing programs or ones in the zone can appeal if less than half of all completers take on debt. Community college officials had pushed for that tweak, given the relatively low price of two-year degree programs. Some community college students default among those who borrow, but the overall number of borrowers is often less than 50 percent of those enrolled. (Note: This paragraph has changed from a previous version to correct an erroneous mention of the cohort default rate.)

Critics of for-profits were disappointed to see the demise of language for a provision that would have required institutions to grant debt relief to borrowers.

Some negotiators in the department-sponsored rule-making session over gainful employment (which ended in a stalemate) had complained about how to comply with that requirement. They said the different period dates and rates used in the two metrics would make it difficult to track borrowers under the relief provision. The department asked for comments on the decision to drop this language.