You have /5 articles left.

Sign up for a free account or log in.

The Pew Research Center recently released two different reports that call attention to at least one issue in higher education.

Report 1: September 2012

“A Record One-in-Five Households Now Owe Student Loan Debt”

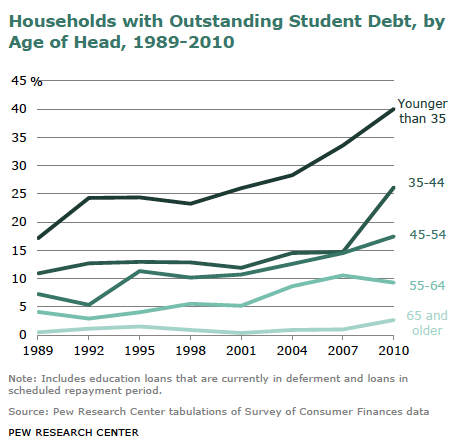

The percentage of households with student debt has risen from 15% in 2007 to 19% in 2012. Not surprisingly, the average student loan balance has also increased 14% from 2007 to 2010 to ~$26,682. Another statistic is highlighted below – a record 40% of households headed by someone under 35 years old now have student debt.

You can read the overview or the full PDF report for more data.

Report 2: November 2012

“Record Shares of Young Adults Have Finished Both High School and College.”

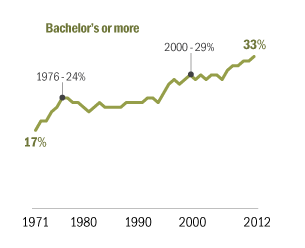

Essentially, this report calls attention to the fact that for the first time, one-third of the 25-29-year-olds in the United States have completed a bachelor’s degree or more.

Record Highs in U.S. Higher Education

You can read the overview or view the infographic for more data.

These two reports highlight one rising tension in higher education. On one hand, a college degree has become increasingly important in a knowledge economy. On the other hand, costs have increased and more people are borrowing more money to attend college. This underscores questions that have been raised both from the perspective of what students actually learn and what their earning potential becomes. This issue is a topic of continuing discussion in our online class Strategy and Competition in Higher Education running again this Spring.

Stay tuned for Part 2.