You have /5 articles left.

Sign up for a free account or log in.

Getty Images

I teach in an economics department. This is a hot field for undergraduates. Many students and their families believe that “practical” majors like economics or business pay off with better job prospects. Humanities majors are seen as financial losers.

As a faculty advisor to incoming students, I have seen this mercenary attitude about what to study rising over time. Although there are earnings differences between majors, choosing an academic major just because of those differences is a profound mistake for most students.

Here’s how a conversation with a freshman advisee might go:

Johnny: “My dad says that business majors make a lot more than English majors. He wants me to sign up for business degree, so I need to take the calculus and economics prerequisites right away.”

Me: “Are you a good writer?”

Johnny: “Yes. I have always devoured books, I love journalism, and …

Me: “Do you have the same love of mathematics and statistics?”

Johnny: “Well, no. I can do math but it’s really a struggle and I don’t really enjoy it.”

Me: “So, let me get this straight. You want to give up being a good English major so you can become a weak business major who finds that field deadly dull.”

Johnny: Looking rather sheepish, “Well, but my dad …”

A brief look at earnings data might help Johnny and his dad.

Professor Douglas Webber of Temple University has created a very user-friendly database on expected lifetime earnings, measured in today’s dollars, for 83 majors. This spans the spectrum from high earning disciplines like aerospace engineering and economics to lower earning disciplines like studio art or social work. I have picked two common majors (general business and English) to illustrate how easily parents and students can misunderstand and misuse this information.

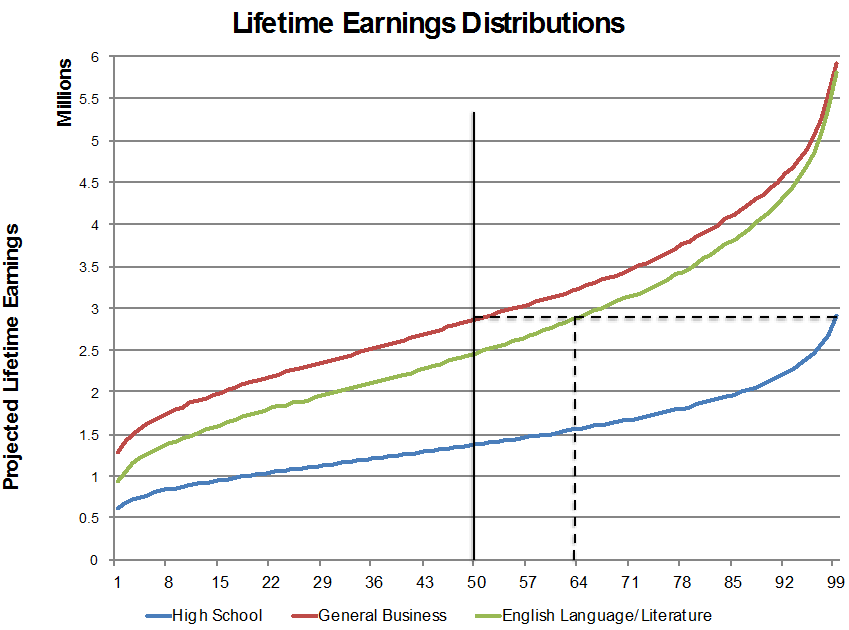

For every major, there is a distribution of earnings. The chart below shows that distribution for business majors and English majors, and for people whose education stopped with a high school degree.

Some people are high flyers. The top 10 percent of earners in any field – the 90th to 99th percentiles of their major’s earnings distribution – will make substantially more over their working lifetime than people in the middle of the distribution are likely to earn. The low percentiles reflect people who aren’t fully employed or who have moved into and out of the labor market. Usually this is a choice, and often that choice is about raising a family.

The chart tells many stories. First, the earnings gap between most college degree holders and most people who only complete high school is very large. Yet a college degree does not guarantee financial success. Some people with only a high school degree wind up earning more than some people with a college degree.

Johnny’s dad sees that the business degree holder in the middle of the distribution (at the 50th percentile) earns almost $400,000 more over a working lifetime than the median English degree holder. That is why he steers his son away from a “useless” humanities degree.

That might be reasonable financial advice if a graduate’s position on the earnings distribution is the same, no matter what he or she chooses to study. But that assumption strains credulity. A person at the 70th percentile of the English earnings distribution would not necessarily be at the 70th percentile of the business, mathematics, or economics distribution. People have distinct talents and interests. They often choose what to study based on those talents and interests.

Just as a financial calculation, suppose that Johnny is indeed better at the skills of an English major than he would be as a business major. If his talents place him at the 64th percentile of the English major earnings distribution he would earn just as much as the median business major. And if his struggles at statistics placed him at the 40th percentile of the business major’s earnings distribution he would lose over $240,000 of lifetime earnings by following his father’s advice.

People are malleable to some extent, but by the time a student is in high school many of the skills and interests that point students toward certain majors are substantially in place. If a student follows his or her interests, this can lead to greater skill acquisition and ultimately to a more satisfying and higher earning career than following a chart that shows how much more an “average” business major makes than an “average” English major.

The information on earnings by major does reveal important things. First, high earning degrees tend to be in fields that are highly quantitative. Students who show quantitative talents early in their K12 schooling should be given every opportunity to follow that path.

Since a student cannot know for sure that she will be a high flyer in the top percentiles of the earnings distribution, people who choose lower earning fields should not borrow as much for their education as students who choose higher earning fields. This common sense idea should be reinforced by financial guidance from the universities they attend.

Lastly, borrowing is not a bad thing. The gap in earnings between the average college degree holder and the average high school educated worker can easily finance the $26,000 to $32,000 taken on by the average borrower who completes a degree. The key is to complete a degree.

I’ll end with a question. For high flyers above the 70th percentile of the earnings distribution, which discipline has the highest earnings? Economics, of course.