You have /5 articles left.

Sign up for a free account or log in.

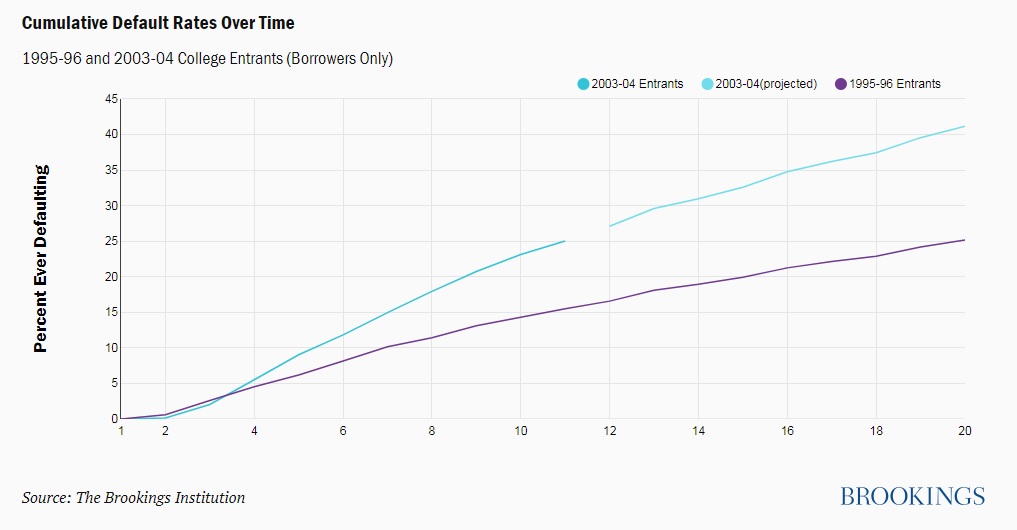

The looming student loan crisis is worse than previously thought, according to a new analysis of federal data on student loan default, which the U.S. Department of Education released in October. The Brookings Institution published the report, which was written by Judith Scott-Clayton, a senior fellow at Brookings and an associate professor of economics and education at Columbia University's Teachers College.

The federal data show that cumulative default rates continue to rise between 12 to 20 years after students begin repaying their loans, the report said, which means that nearly 40 percent of students who took out loans in 2004 may default by 2023.

In addition, the report said the new numbers reinforce the fact that default rates depend more on student and institutional factors than on average levels of debt. While average debt levels have risen, defaults are highest among those who borrow relatively small amounts.

Default trends among students who attend for-profit colleges are the most alarming, according to the report, which also said debt and default among black college students are at crisis levels.