You have /5 articles left.

Sign up for a free account or log in.

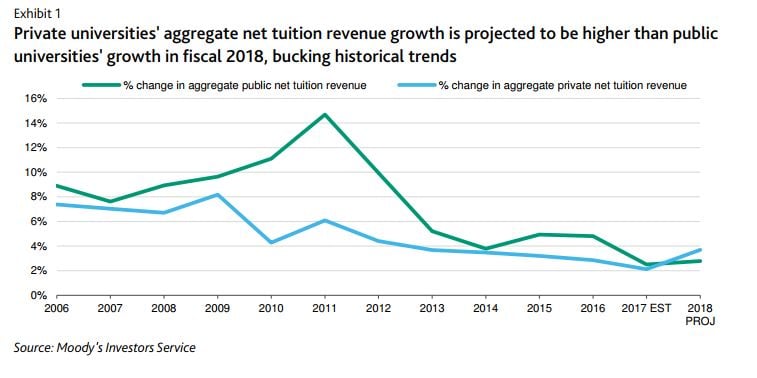

Private colleges and universities are expected to grow tuition revenue faster than public institutions in 2018, breaking from recent trends, according to an annual survey of colleges rated by Moody’s Investors Service.

Median net tuition revenue growth at surveyed private universities is expected to notch 2.4 percent. Median net tuition growth at public universities is only expected to come in at 2 percent.

The projected growth is still relatively low, Moody’s noted. Universities face a competitive environment and slow growth in total enrollment, constraining their power to raise tuition.

Private universities are expected to see their highest net tuition growth since the 2014 fiscal year, when it was 2.9 percent. They are being boosted by overall enrollment stability and a median annual sticker price increase of 3.7 percent. Still, tuition discounting is continuing to grow, offsetting that sticker price increase when net tuition revenue is calculated. Differences also emerge based on institutional location and size. Comprehensive private universities are expected to do much better than small institutions.

Public universities are facing median tuition growth that has consistently slipped since 2015. High competition for students, political constraints on raising tuition and an affordability focus are behind the slow growth. Small public universities are feeling the most pressure.