You have /5 articles left.

Sign up for a free account or log in.

A new report from the Century Foundation questions the legitimacy of four former for-profit colleges' recent transformations to nonprofit status. Those institutions are "covert for-profits," according to the report, "where owners have managed to affix a nonprofit label to their colleges while engineering substantial ongoing personal financial benefits for themselves."

The report's author is Robert Shireman, a former U.S. Department of Education official who recently joined the foundation as a senior fellow. The report said several for-profits have sought to become nonprofits to avoid federal regulations, some of which Shireman worked to create. By using public information requests, Shireman wrote case studies about the conversions of Herzing University, Remington Colleges Inc., Everglades College and the Center for Excellence in Higher Education (CEHE).

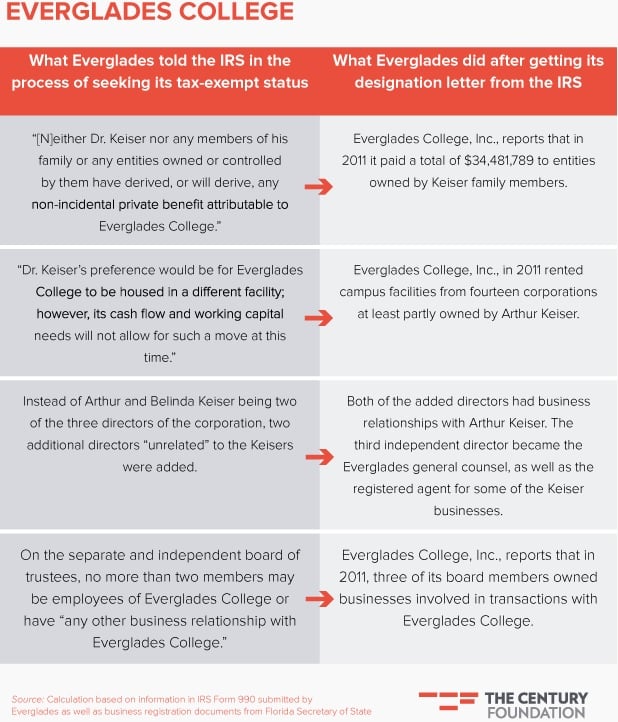

All four of the institutions signed contracts committing them to pay their former owners hundreds of millions of dollars, the report found, while those former owners remain involved in the governance of the nonprofits. For example, Keiser University told the IRS that neither its founder, Arthur Keiser, nor his family members would receive any "nonincidental private benefit attributable" to the newly nonprofit Everglades College. Yet in 2011 Everglades paid more than $34 million to entities owned by Keiser's family members.

Despite what Shireman called the "egregious" examples of covert for-profits, the IRS and the Education Department have failed to crack down. The reason, he said, is a regulatory blind spot where each agency assumes the other is doing the monitoring.