You have /5 articles left.

Sign up for a free account or log in.

iStock/Aleutie

The growing amount of student loan debt has been labeled a national crisis as more low-income students seek to attend colleges and universities where the cost of attendance continues to rise. But some researchers are questioning whether the ballooning amount of student debt is truly a crisis if it helps students reach their academic goals and leads to well-paying jobs.

A new study published in Education Next by Benjamin Marx, an assistant professor of economics at the University of Illinois at Urbana-Champaign, and Lesley Turner, an assistant professor of economics at the University of Maryland, College Park, found academic benefits for community college students who got loans after their institutions informed them of the amount of money they could borrow.

“The loans helped students take more classes, but that doesn’t seem to be the only or main effect,” Marx said. “Students actually did better in their classes when they had a student loan.”

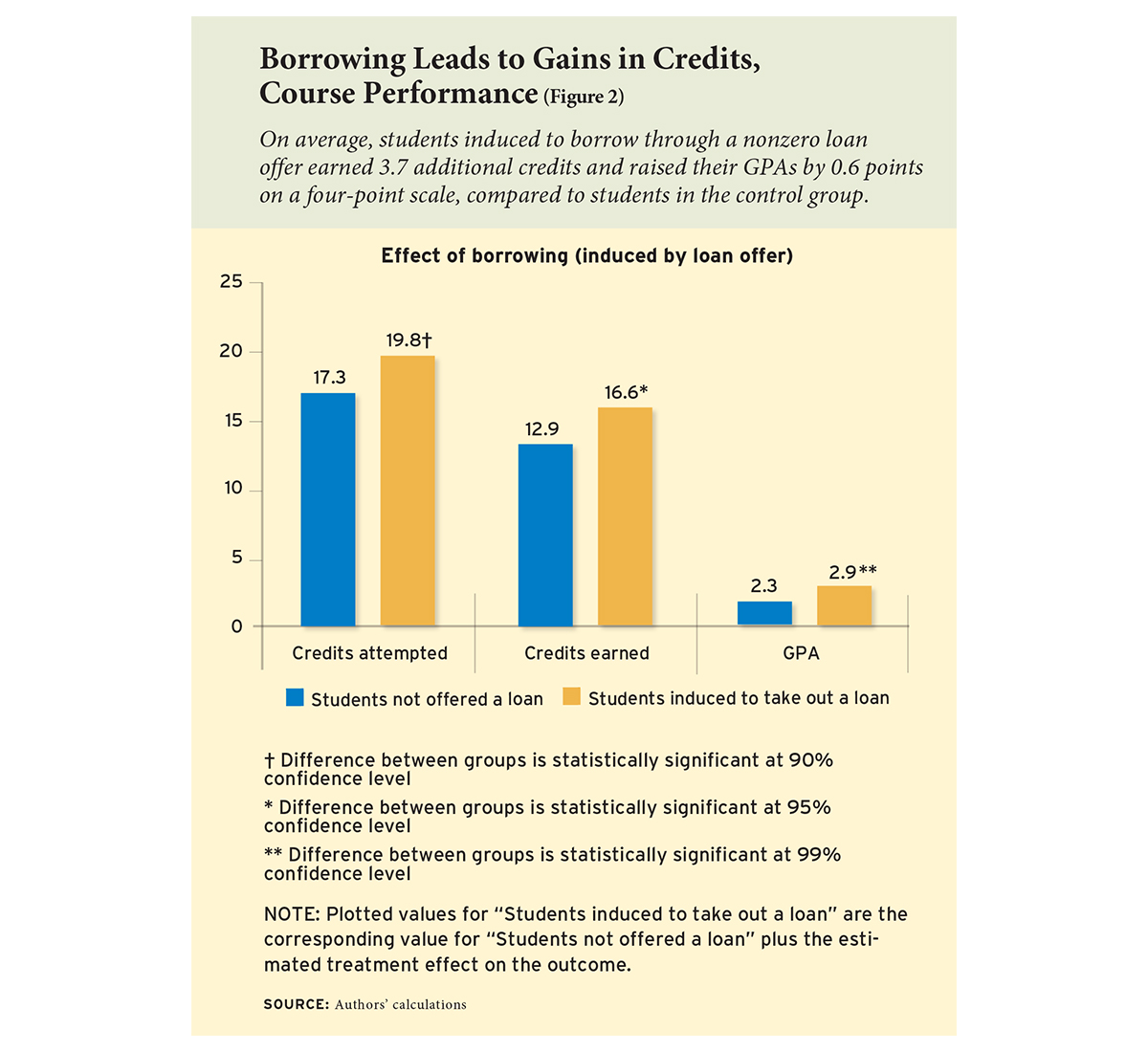

The researchers learned that students who were given a loan offer with a dollar amount in their financial aid letters were more likely to borrow. And they academically outperformed their peers who did not borrow. These students earned 3.7 additional credits and raised their grade point averages by more than half a grade on a four-point scale by the end of the 2015-16 academic year.

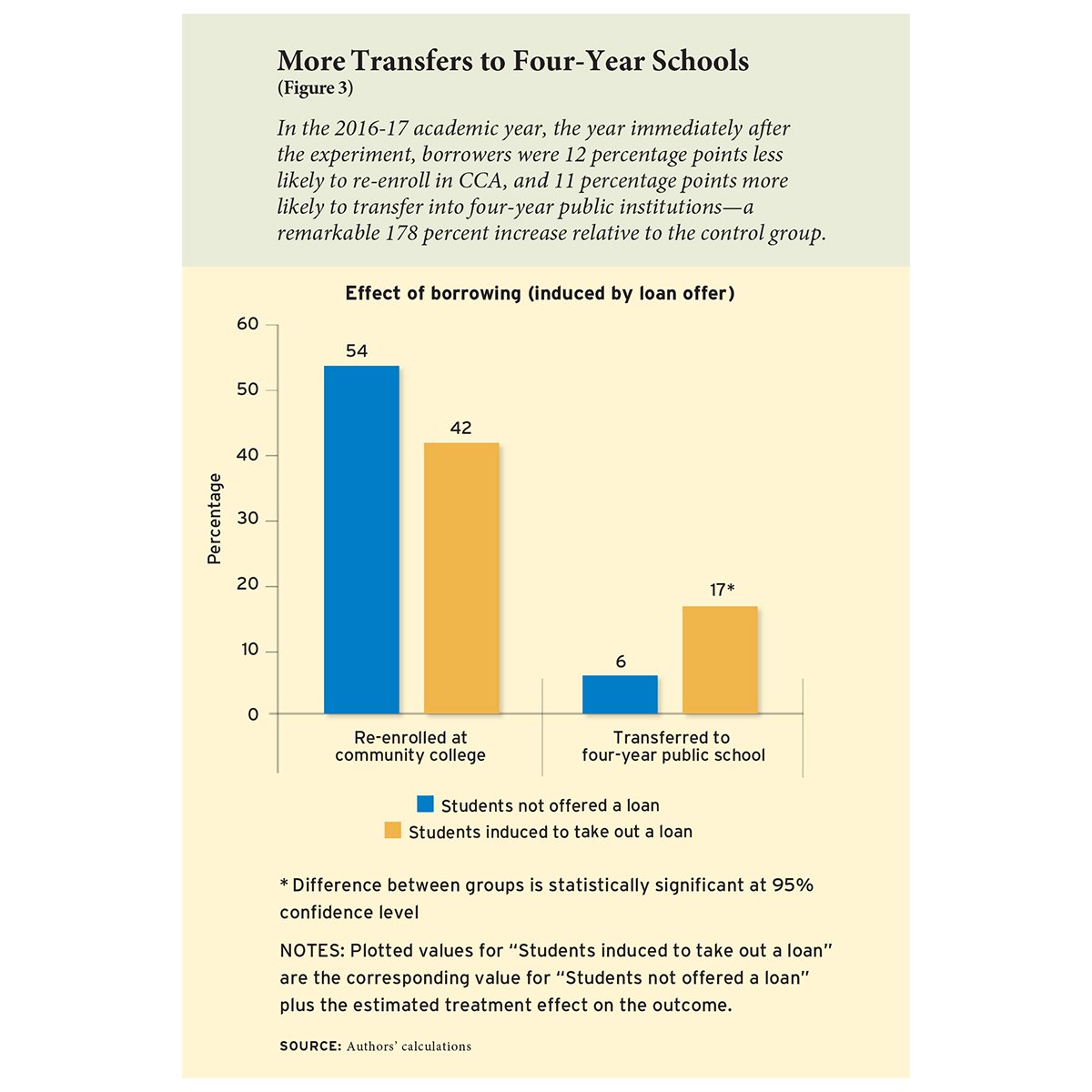

Students at the unnamed community college where the researchers conducted the study were also 11 percentage points more likely to transfer to a four-year institution one year after receiving the loan offer compared to those students who did not receive an offer. The researchers said it was unclear if students who re-enrolled one year after not receiving a loan offer either transferred after their second year or graduated. Marx said they are following up with the college for more results.

The study challenges the conventional wisdom that student debt is a problem. U.S. secretary of education Betsy DeVos warned last year that the growing $1.5 trillion federal student loan balance demanded the attention of Congress. Only 24 percent of borrowers are paying down both principal and interest on their federal loans, she said.

Marx said there may be two explanations for why student borrowers outperform their peers.

“Now a student knows they have to repay a loan in the future, and they take their studies seriously,” he said. Loans also provide students with additional financial resources, which means they don't have to spend as many hours working to earn money and can take more classes instead.

“We know a lot of these students are working part-time while taking classes, so having some money available allows them to deal with negative situations that may arise, like if someone in their family is sick,” Marx said.

Marx and Turner examined thousands of community colleges and learned that about five million students attend institutions that do not offer or package loans in financial aid award letters, nearly another five million attend institutions that do notify students of available loans, and about one million attend colleges that don’t participate in the federal loan program.

As part of their study, the researchers in 2015 examined a large community college that chose to remain anonymous. The college charged about $3,100 a year in tuition and fees, and about 45 percent of students at the institution received federal financial aid. Twenty-five percent of students at the college received federal loans. Nationally about 19 percent of community college students get federal loans.

The college divided financial aid-eligible students into two groups of about 10,000 students each. One group received award letters that detailed up to $4,500 in loans they could receive. The other group received letters that didn’t list a specific loan offer.

The results resembled those of the renowned City University of New York’s Accelerated Study in Associate Programs, or ASAP, Marx said. The CUNY program provides free tuition, textbooks, public transportation and regular contact with an adviser for students. After three years, 40 percent of ASAP students graduated from CUNY colleges, compared to 22 percent of students who didn't participate in the program. Three Ohio community colleges that have adopted the ASAP initiative also have seen graduation rates increase, from 7.9 percent to 19.1 percent. But many colleges don’t have the money and resources to replicate ASAP on their campuses, Marx said.

Although they don't have graduation data, the researchers expect the loan effect to also increase graduation rates. They noted that students who get degrees increase their earning power and are better able to repay loans. The study estimates graduates will earn, on average, $370 more per year if they took out a $4,000 student loan.

Marx said informing students about how much they can borrow and how the money must be repaid to the federal government may be a cost-effective strategy for colleges that want to see students taking more classes, earning more credits, transferring to four-year institutions and graduating.

“From a college's perspective, it is essentially free,” he said. “Students are borrowing from the government. They’re not borrowing from the colleges.”

Some colleges, however, have chosen to stop participating in the federal loan program because of the risk that their graduates won't repay the loans. A few California community colleges have even turned down state money for free tuition because of a requirement that they participate in the federal loan program. The colleges don’t want to risk increasing their institutional default rate because they can lose access to federal funds when their default rate exceeds 30 percent. The national default rate for public community colleges is 16.7 percent.

“It’s understandable some colleges have chosen to opt out of the loan program, but that is not good for students,” Marx said.

Colleges that don’t package loans in an award letter don’t necessarily prevent the neediest students from borrowing. Those students will take out loans but are also less likely to repay in the future, Marx said. The college would be in a better position by packaging loans so they could get more borrowers, who in some cases may be less needy and thus lower their default rates, he said.

The ideal situation would be ensuring students don't need loans in the first place, said Debbie Cochrane, executive vice president at the Institute for College Access and Success.

“The findings of the study are very important and need to be considered carefully by colleges when deciding whether to offer loans and how to talk to students about loans,” she said. “But the best-case scenario for students is to afford college costs without needing to borrow. Borrowing is not the ideal outcome for any student at any type of college.”

Cochrane said colleges should tell students about how much in student loans they can borrow if they don't have any other financial options. But default rates indicate there may be more problems at colleges than whether graduates can repay or not.

“Student default rates at community colleges reflect a couple of things,” she said. “One is that too few students are graduating, and certainly more colleges could be doing more to focus on student success. It’s also true community colleges often invest less in financial aid administration, including default prevention, than other types of colleges.”

Loans may be one solution for helping students afford college and increase achievement, but grants that don't have to be repaid is another. The researchers are working on a new study that examines the academic effects of federal loans versus grant aid and agree that the effects of the federal Pell Grant may be stronger on academic performance, Marx said.

“There is a mountain of research showing grant aid or need-based aid certainly increases the chances of low-income students graduating from college,” said Mark Huelsman, associate director of policy and research at the think tank Demos. “If our goal is to maximize the amount of credits students are taking or maximize their attention to academics, then it’s still pretty clear that grants are better than loans, but student loans, if they are the only or last resort for students, can be beneficial.”