You have /5 articles left.

Sign up for a free account or log in.

Istockphoto.com/ipopba

Do college and university presidents believe their institutions are well prepared to adapt to the major headwinds facing higher education? And are their institutions operating in ways that suggest they are well positioned?

Not really, to judge by a report and survey published Monday by the American Council on Education, Huron Consulting Group and the Georgia Institute of Technology.

The report, "The Transformation-Ready Higher Education Institution," included a survey of nearly 500 senior administrators at four-year colleges and universities, roughly half of whom were presidents and chancellors.

The survey sought to gauge the campus leaders' assessments of the most significant challenges awaiting their institutions in the next three to five years, how prepared they felt to respond to those pressures, and whether their institutions were structured and managed with agility and responsiveness in mind.

Asked to rate which trends they most expected to affect their institutions over the next half decade, 62 percent of campus leaders listed increasing competition, followed by the declining traditional-age student population (59 percent), the increasing population of working adults and other nontraditional students (39 percent), declining federal and state financial support (38 percent, though much higher for public universities), declining public confidence in higher education (27 percent), and geopolitical uncertainty around international students (23 percent).

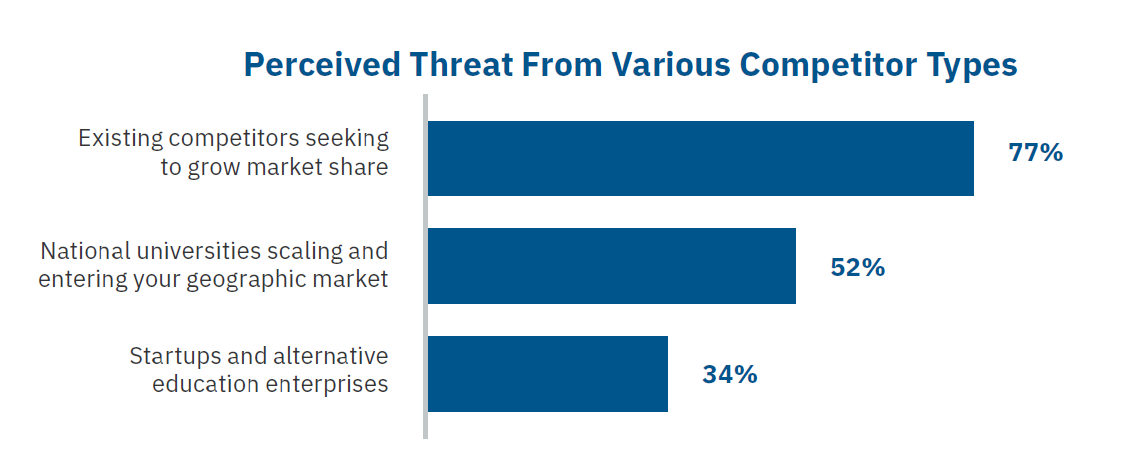

For all the talk from "disruption" advocates about the emergence of new competitors such as boot camps or new credentials from major companies such as Amazon or Google, four-year-college leaders are much more concerned about competition from within.

As seen below, they worry less about new alternative providers than about existing competitors expanding their footprints and "national universities" that might expand their scope, either through online expansions aimed at adults (such as Western Governors or Southern New Hampshire Universities) or lower-priced graduate programs that could compete with their own (such as the engineering program started by Georgia Tech, one of the report's authors).

Eighty-six percent of respondents also said they expected the competitive intensity to increase going forward; 11 percent said they expected it to stay the same.

"Administrators at all but the most selective institutions believe their institutions are threatened by scaling flagship national universities that are making substantial investments in their online programs," the report states.

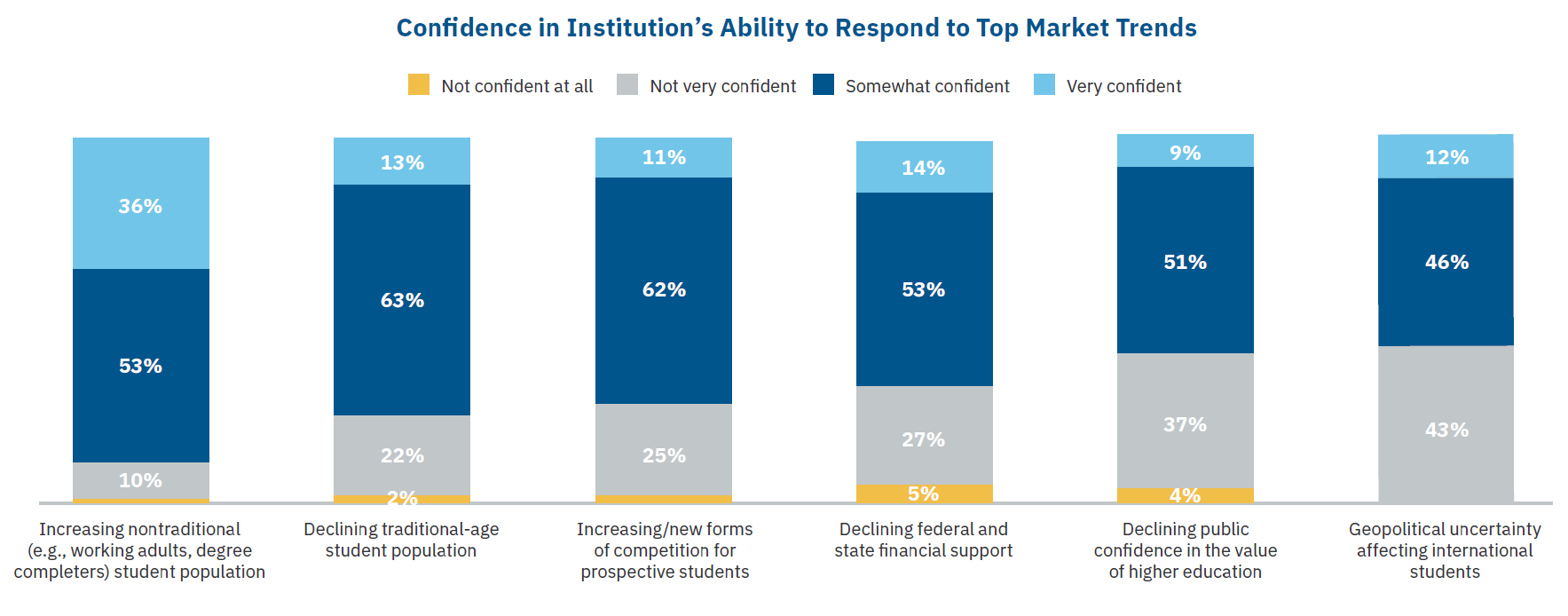

Campus leaders are not supremely confident in their institutions' ability to respond to the market trends cited above.

As seen in the chart below, 89 percent of senior campus leaders said they were either very (36 percent) or somewhat (53 percent) confident in their institution's ability to respond to the increasing representation of working adults in the student population -- a confidence that is not widely shared by experts who specialize in that population.

On none of the other five market trends did more than one in seven campus leaders say they were "very confident" in their institution's capacity to respond -- and a quarter or more said they were not very confident in four of those five cases.

The institutions' perceived ability (or lack of it) to respond agilely to changes on the landscape is unsurprising given how colleges spend their money and plan for the future, the report suggests.

When asked which expense trends most concerned them in the next five years, campus leaders cited workforce costs, financial aid and tuition discounting, and facilities project and maintenance -- hardly the logical focus for institutions trying to adapt to an increasingly digital world in which adult students predominate.

And a majority of respondents to the survey (57 percent) said they were planning three to five years into the future, with 8 percent saying less than three years and 16 percent saying 10 years or more.

"Most institutions still plan for the 'medium term' -- not fast enough to be agile or future-facing enough to be transformational," the report states.

If there are reasons for optimism in the survey, they may be found in answers to a question about how institutions plan to respond to heightened competition and in data on how the most confident colleges and universities in the sample are behaving.

First, asked how they expect to respond to increased competition, far more respondents said they would add or kill off academic programs to respond to demand (77 percent), expand online offerings (69 percent), or invest in enhanced student services and technology (62 percent) than plan to "grow prestige or rankings" (43 percent), which has been a traditional response by some four-year universities to improve their competitive posture. (Barely more than a third, though, said they would cut costs to lower or maintain tuition levels.)

Second, the roughly one in six leaders who expressed confidence in their colleges' ability to change in response to market trends are significantly likelier than their peers at other institutions to plan at least six years out, to use business intelligence and analytics, and to take a strategic technology management approach.

"Highly confident leaders are much more likely to be found at institutions with planning and performance measurement tools integrated across the organization," the report states.

A webcast on the results will be held today.