You have /5 articles left.

Sign up for a free account or log in.

A new web tool from the Urban Institute reveals the geographic distribution of student loan debt, with interactive data on debt levels and the share of people who took out student loans at both state and county levels.

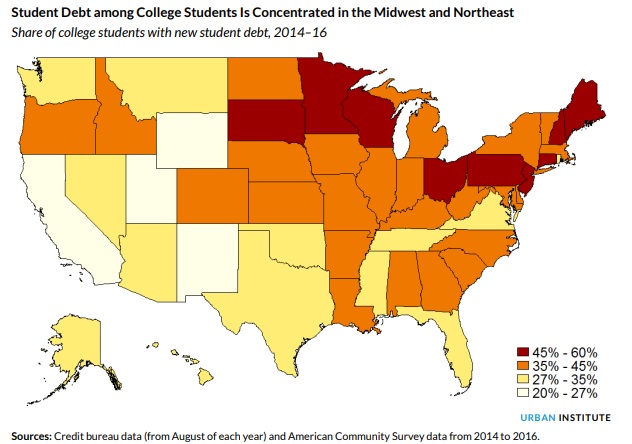

The Northeast and Midwest have the highest portions of college students who borrow (45 percent and 44 percent, respectively), according a related paper the institute released today. Students from the Northeast also borrowed the most, with an average annual amount of $8,749.

Perhaps unsurprisingly, the share of college students who borrow in a state is “highly correlated with the cost of attending a public four-year college in that state,” according to the brief.

Likewise, states with high student debt levels tend to have four-year public institutions with higher average costs. New Hampshire leads both those categories, the institute found. Wyoming, which has low student debt levels, has the lowest average cost at its four-year public colleges.

“States with high tuition for four-year colleges and little financial assistance typically have a large share of college students using student loans to finance their education,” the paper said.

The tool and paper draw from federal data sources as well as credit bureau data and tuition information from the College Board. The tool’s 2016 data cover all adults with a credit file, while the related brief is limited to people who were between 19 and 22 years old, for a look at those who take on debt early in their college years.

The Urban Institute’s debt-tracking release follows other looks at regional student debt distribution, including those produced by the Institute for College Access and Success and the Washington Center for Equitable Growth.

College students in the western U.S. are the least likely to borrow, the institute found. About 26 percent of students in that region took out loans to attend college, according to credit bureau data. New Mexico, Wyoming and California are at the bottom of this list, with just 23 percent of college students borrowing in California, which has relatively low tuition levels at its public institutions.

On the other side of the country, New Hampshire, Maine and Pennsylvania are among states with the largest shares of undergraduates who borrow -- 58 percent in New Hampshire.

"We present new statistics on the distribution of student debt and the cost of attending college, but it is out of the scope of this study to discuss whether students borrow too much or too little in specific regions,” the paper concludes. “If the financial return on a college education is high enough, it is possible that students in a state would be more likely to take out loans to finance their education but less likely to default on those loans.”