You have /5 articles left.

Sign up for a free account or log in.

Blackboard

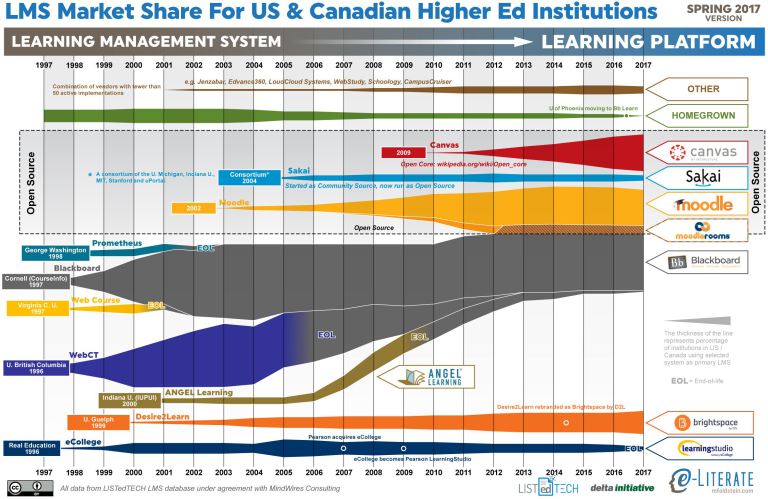

There are many conclusions one might draw from e-Literate's latest report on the state of the learning management system market, highlights of which the analysts published on their website this week. But one conclusion that you'd be hard pressed to reach -- despite lots of rhetoric to the contrary -- is that the LMS is dead.

"The numbers don't back up the idea that the LMS is becoming irrelevant," said Phil Hill, co-author (with Michael Feldstein) of the e-Literate report, "State of Higher Ed LMS Market for US and Canada: Spring 2017 E dition," and Feldstein's partner in Mindwires, the consultancy that publishes the report. "In fact, if anything, institutions are choosing the mainline LMS's even more than they did a year or two ago."

dition," and Feldstein's partner in Mindwires, the consultancy that publishes the report. "In fact, if anything, institutions are choosing the mainline LMS's even more than they did a year or two ago."

That doesn't mean, however, that college and university administrators and professors are satisfied with their learning management software, or that the providers aren't "in the process of morphing to try to address what people are asking for," Hill said.

Digging Into the Numbers

e-Literate began producing its twice-a-year analysis of the LMS market last year for subscribers in conjunction with LISTedTECH, a higher education data company. Separately, the analysts have been producing a market share graphic (see below) for nine years. (They call it the "squid graphic" -- guessing you can figure out why.)

As seen in the table below, the market share for the various LMS providers this spring compared with a year ago, based on data from 4,520 institutions in the U.S. and Canada, looks like this:

| Spring 2016 | Spring 2017 | % Point Change | |

| Blackboard Learn | 34% | 33% | -1% |

| Moodle | 25% | 24% | -1% |

| Canvas | 14% | 19% | 5% |

| D2L Brightspace | 11% | 13% | 2% |

| Sakai | 4% | 3% | -1% |

| LearningStudio | 4% | 2% | -2% |

| ANGEL | 2% | 1% | -1% |

| Homegrown | 2% | 1% | -1% |

| Other | 4% | 4% | - |

While the numbers change relatively modestly from season to season, the trends are unmistakable:

- Instructure's Canvas and, to a lesser degree, D2L's Brightspace are seeing their market share grow.

- The open source providers, Moodle and Sakai, are losing ground modestly.

- Blackboard remains the market leader, with most of its leakage stemming from its decision to shut down ANGEL, which it bought several years ago.

- Another end-of-life product, LearningStudio, which Pearson announced a year ago it was shuttering, was the biggest loser over the last year.

The last two lines of the table are what led Hill to assert above that the movement in the market is toward, not away from, the mainstream learning management systems. Homegrown LMSs and the catch-all category of "other" are either flat or shrinking. The latter category includes software with fewer than 50 institutions, including LoudCloud, Jenzabar, Edvance360 and Schoology.

"Of these," Hill writes, "Schoology is growing the most, primarily from smaller private institutions (their sweet spot)."

While e-Literate's data may not suggest a crisis is at hand for LMS providers, Hill warns that they should not be sanguine. Users are increasingly demanding learning platforms that play well with other technologies and integrate data from various sources, so monolithic systems are unlikely to thrive.

And where as recently as 5 to 7 years ago, most of the institutions that were switching (or considering switching) LMSs did so because the product they were using was phased out, "we're now seeing a lot more voluntary adoption," Hill said. "The default ... is that people want something better, so they're doing an LMS selection."

The two biggest drivers of those competitions, he said, are the existence of Canvas -- the only one of the leading LMSs "that wasn't designed in the late 1990s/early 2000s" -- and expectations from consumers who are increasingly frustrated by some of the poor user experiences in many LMSs.